Skip the searching and find the top financial products of 2024, all in one spot. From insurance companies to investment accounts, we’ve got you covered.

Taxes

Supreme Court Rules Tax On Previously Untaxed Foreign Profits Is Constitutional

A 2017 Tax Cuts and Jobs Act provision that requires companies to pay tax on…

IRS Issues FAQs On Retirement Plan Distributions And Loans Following Major Disasters

The IRS has answered some frequently asked questions (FAQs) relating to rules for distributions from…

Why You Might Want To Choose A Used EV Tax Credit Over A New One

Since 2023, qualified used electric vehicles have been eligible for a federal tax credit for…

Don’t Wait Until The Tax Cuts And Jobs Act Expires To Do Your Estate Planning

Working with estate planning attorneys can involve a lot of emails projecting doom and gloom…

How To Avoid Faulty Advice On IRS Form 706 And The Portability Election

There is an onerous issue plaguing the tax community. Some tax professionals have been advising…

How Capital Gains Tax on Home Sales Works

If you sell your home for a profit, the IRS considers this a taxable capital…

Treasury Secretary Yellen Indicates U.S. Will Not Support Global Billionaire Tax

The world’s ultra-rich should pay more in taxes. That’s the crux of a proposal by…

What Are the Tax Consequences of Inheriting a CD?

If you inherit or plan to bequeath a certificate of deposit (CD) as part of…

Don’t Roll Over RMDs To Other Retirement Accounts

Some retirees continue to make a key mistake with required minimum distributions, and that could…

Copilot+ PCs Could Be A Privacy Nightmare For Professionals

On a May 20th event on Microsoft’s Microsoft campus, the Redmond, Washington company introduced Windows…

IRS Extends Free File Program Through 2029, While Direct File Future Remains Uncertain

The IRS will extend the Free File program through October 2029, following an agreement to…

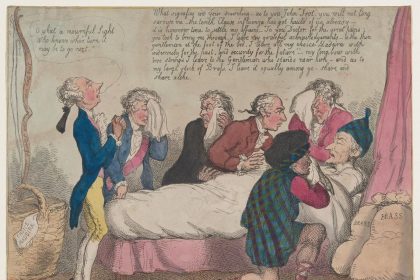

In Terrorem Clauses In Estate Planning

Disinheriting a child or family member from one’s estate plan can be one of the…