Skip the searching and find the top financial products of 2024, all in one spot. From insurance companies to investment accounts, we’ve got you covered.

Taxes

Surprisingly, Taxes Are Present Even At Your Local Farmers’ Market

“Do you need an invoice for your taxes?” the farmer asked. The buyer grabbed her…

IRS Introduces Process For Third-Party Payers To Withdraw Bad Employee Retention Credit Claims

The IRS is not backing down on efforts to stem the tide of what it…

How TurboTax Is Using AI To Demystify Taxes For Spanish Speakers

Leer en Español With the tax deadline looming, the more than 40 million U.S. residents…

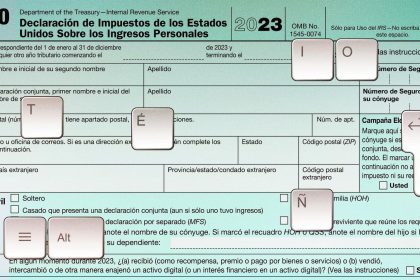

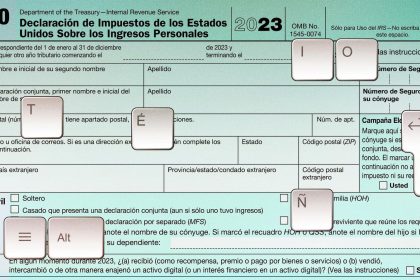

TurboTax Está Utilizando La IA Para Desmitificar La Declaración De Impuestos Para Los Hispanohablantes

Read in English El último día para declarar impuestos se acerca, y los más de…

It’s Been Quite The Filing Season, But Tax Day Is Almost Here

This is a published version of our weekly Forbes Tax Breaks newsletter. You can sign-up…

IRS Gives Another Breather To Taxpayers Who Have Inherited IRAs

The IRS is offering a breather for taxpayers tied to certain specified required minimum distributions…

Tax Implications for Reverse Mortgages

A reverse mortgage can be a useful way to access the value of your home…

Who Will Benefit From O.J. Simpson’s Estate? It’s Complicated

Before he died from cancer at the age of 76 earlier this month, O.J. Simpson…

9 Common Tax Mistakes and How to Avoid Them

The more money you make, the higher your tax liability could be. And making a…

Understanding Form 8606 for IRA Taxes

If you use an IRA to save for retirement, IRS Form 8606 might be an…

IRS Whistleblower Littlejohn—Between Weaponizing And Whistleblowing

In the annals of modern whistleblowing, the name Charles Littlejohn is not likely first to…

What Is Net Investment Income and How Is It Taxed?

Net investment income (NII) is defined as the profit gained from investments after deducting certain…