You’ve scrimped and saved like Uncle Scrooge, and now you’re ready to put that pile of cash toward buying a house. Congrats! But dropping hundreds of thousands of dollars on a home can feel about as high-stakes as putting all your chips on black and spinning the roulette wheel—especially if you don’t know how to spot a money pit.

But here’s the good news: Knowing what to look for when buying a home doesn’t have to be anxiety-inducing. I’ll make it real simple for you.

Once you’ve settled on things like price, size, school district and neighborhood, you’ll need to know if a home has good bones—is it built to last or does it have some serious problems? (Tip: A home with an outhouse is a hard pass for me.)

So, here’s my list of seven important things you should look for when buying a house to help you feel confident you’ve got a rock-solid home. I’m talking Dwayne “The Rock” Johnson solid.

7 Key Things to Look for When Buying a House

Before we launch into the details of what to look for when buying a home, make sure you’re financially (and emotionally) ready to buy a house. Once you’ve got the green light to start looking at houses, keep an eye out for these seven things.

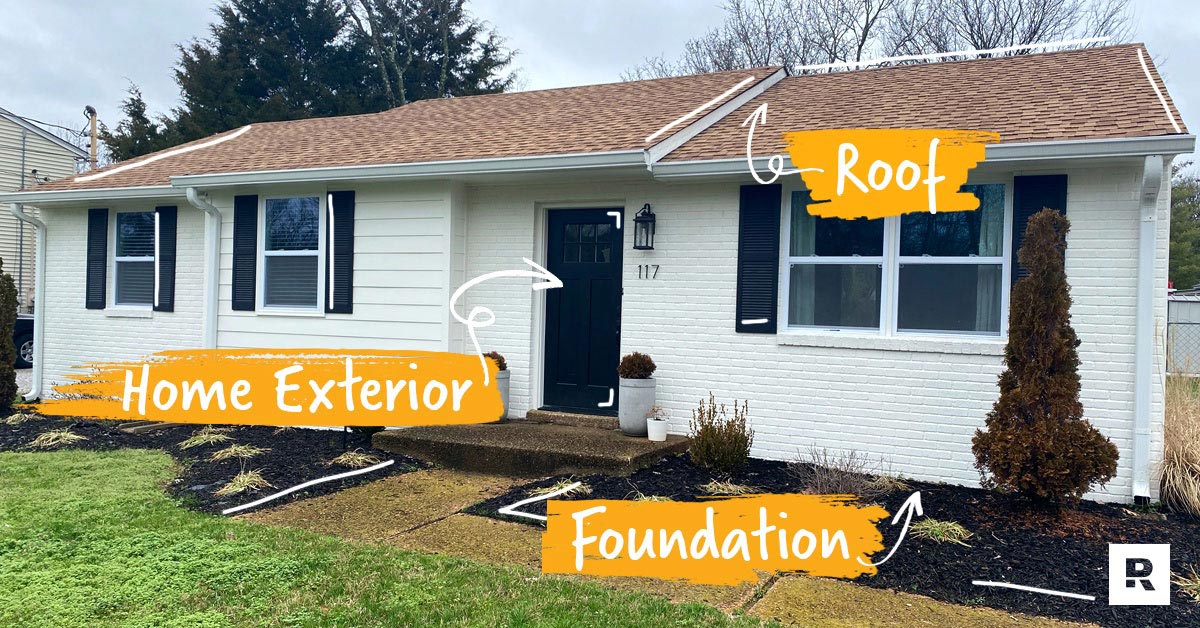

1. Roof Condition

Unless you’re Inspector Gadget (go, go gadget legs!), you probably won’t be able to see a home’s roof up close during a showing. But that doesn’t mean you can just ignore it—after all, the average cost to replace a roof is about nine grand.1 Yeesh. That’s steeper than an A-frame roof! (I’m a dad now, and the dad jokes are flowing.)

So here’s how to avoid surprise roof repairs by figuring out a roof’s condition with these questions:

- How old is the roof? If you want to know how long a roof is going to last, you need to know its age and what it’s made of. You can find this info on the seller’s disclosure—or ask your real estate agent to find out. Asphalt shingle roofs last around 20 years, but other materials, like clay or metal could last a lot longer. Once you know a roof’s age, compare that to the typical lifespan of the material it’s made of to see how long it’s got left.

- Does the homeowner have a roof certification letter? Some contractors give roof certification letters after an inspection that estimates the lifespan of the roof over the next 2–5 years.2 Not all sellers will have this, but it never hurts to ask.

- Are there any signs of damage? Now, if you’re like me, you have zero roofing skills. But sometimes you can eyeball a roof and see that it needs work if it has missing, cracked or curled shingles. Also, look inside at the ceilings for any signs of a leaky roof. See yellow or brown spots on the ceiling? That’s not modern art (although it could cost you the same pretty pennies for repairs).

- Can a roof inspection clear things up? If you’re concerned about the roof’s age and condition, you may want to get a roof inspection. Roof inspections are different from home inspections, since home inspectors don’t always check out the roof. If you go by the home inspection report alone, you could miss some costly repairs.

2. Reliable HVAC

Unless you’re okay with wearing a Snuggie around the house all winter (no judgment here), you need to make sure the HVAC system heats and cools properly. As you look at houses, you should ask about the type of heating and cooling system each one has and—most importantly—how old it is. You also may want to ask if there are any maintenance records you can look at.

Find expert agents to help you buy your home.

Here’s a pro tip: If you’re looking at houses in the summer, find a vent to see if the air blowing out of it is cold. Then find the thermostat and switch on the heat for a minute or two to see if the air warms up.

Furnaces and AC units typically last anywhere from 10–25 years. If a unit is broken, repair costs vary based on the type of system and how big it is. You’ll spend $7,000 on average to replace an existing HVAC unit—but don’t count on a home warranty to automatically cover that.3

If a home’s HVAC system is under a decade old and doesn’t have rust, water damage, suspicious-looking cracks or weird sounds coming from it, there’s a good chance you’re in the clear. But if you’re still worried, remember a home inspector should find any major issues. Then you can work with your real estate agent on any repairs you’d like to request.

3. Plumbing Issues

If your only familiarity with pipes and plumbing is from the hours you spent as a kid playing Super Mario, don’t worry. Examining sewer lines, tubs, sinks, toilets and water heaters can help unclog (yep, I went there) some of the confusion around potential plumbing issues. You need to ask these three questions:

- How fresh are the sewer lines? If a home is 20-plus years old and the seller hasn’t provided any disclosures, get a sewer inspection. Pipe disintegration, obstructive tree root growth, or some pretty righteous clogs can all jack up the system. Keep in mind that sewer line replacement ranges anywhere from $1,300–4,900. Yikes.4

- How do the toilets, sinks, tubs and showers look? Check toilets for leaks, unstable bases and discoloration. Yes, you’re allowed to flush the toilet during a home showing, so have at it! The same goes for making sure tubs, showers and sinks are in tip-top shape. Look under bathroom and kitchen sinks for signs of leaks. Turn on the hot water in the sink or tub and see if it gets hot. If it doesn’t get hot, that could mean the hot water heater has problems—and you could end up taking cold showers before work every morning. But here’s a silver lining—my friend Dr. John Delony says cold plunges are good for your mental health.

- What’s the state of the water heater? A water heater usually lasts 10–15 years, and if you look closely, you might find an installation date written on the unit. A new one can cost from $900–1,800 depending on the type you need.5 If it’s making unusual noises when it turns on or it’s rusty, have a pro take a look.

4. Water Damage and Mold

Untreated water leaks or water damage can cause a tons of problems like structural issues, rot and mold—especially in basements. Pay attention to any musty smells in the home as well as water stains on floors, walls or ceilings. If you do move forward on a home you suspect has water damage, your home inspector should be able to give you an idea of how bad it is.

The thought of mold lurking in the dark corners of a home is enough to make you want to take a shower in Lysol. The cost of removal can be anywhere from a few hundred to a few thousand dollars depending on the size of the area affected. To that I say, “No thank you.”

Because mold is a health hazard, you’ll definitely want to get it treated before moving in, but also be sure to find the source of the moisture to prevent future infestations.

If you’re worried about negotiating water damage or mold repairs, remember: Your real estate agent has likely been on both the buyers’ and sellers’ side of the deal before. Ask about their experience and advice for situations like these.

5. Noise Level

One of the most overlooked factors is a neighborhood’s noise level. Just because things are quiet during an afternoon showing doesn’t mean it’s like that 24/7. Think about these questions:

- Is the home by a major road? If you’re really digging the place, make another visit during high traffic times to assess street noise. Even if the house is perfect in every other way, the constant drone of passing Tahoes and tractor trailers may not be worth it.

- Is it near an airport or railroad tracks? Same thinking here. How patient will you feel when a train steamrolls through your newborn’s nap time? Never wake a sleeping baby is basically a federal law in my house.

- Do the neighbors have dogs? Hey, I’m a dog dad, but a neighbor’s dog that barks constantly could be a doggone deal-breaker.

- Is the property a condo or townhome? In a home where you’d actually share walls with neighbors, you definitely want a sound barrier. Do a walkthrough when neighbors are home to see if you can hear them talking or watching reruns of Jersey Shore. Either way, huge red flags.

Neighborhood noise isn’t just annoying, it can also affect the home’s value. Ask your agent if homes in that neighborhood have a comparable value to the same homes in a quieter location.

6. A Good Foundation and Home Exterior

Remember the parable about the wise man who built his house upon the rock? If there’s one lesson we learned from that story, it’s that your foundation matters. Bulging or bowing foundation walls are a sign of structural weakness that can be expensive to repair. The average cost to repair a foundation is $5,000.6

Other easy-to-spot foundation red flags include:

- Cracks in the foundation, drywall or ceiling

- Gaps above doors and windows

- Sunken stairs or porches

- Sloping or uneven floors or tiling

Keep in mind that not every crack means the home is about to collapse. Every home experiences some degree of settling, so some cracks are expected. Let a qualified home inspector tell you whether a minor crack spells major trouble.

7. Outlets and Appliances That Actually Work

That shiny refrigerator in the kitchen may look big and beautiful (and expensive), but does it actually make ice?

If the home you’re interested in includes appliances as part of the deal, you’ll want to make sure they work. This goes for dishwashers, washers and dryers, and even microwaves.

You also want to make sure that the house’s electrical outlets work. Hey, I know it’s crucial for the outlet right next to your bed to charge your phone every night—otherwise, you’d have a crisis on your hands with no doom scrolling Instagram after dark.

Your real estate agent may give you a funny look, but bring your phone charger with you when you look at a house to test outlets as you walk through. If your phone starts charging, you’ll know the outlet is good to go! If it doesn’t, that could be a sign of a bigger electrical problem.

Red Flags to Look Out For

Alright, I’ve covered a bunch of stuff you should look for when buying a house. I’ve also discussed several things you don’t want in the home you buy for you and your family. (An active house fire or hostage situation are two more things to avoid.)

So let’s recap the big points we talked about, focusing this time on red flags to beware of. You should be extra careful about buying a house with . . .

- An HVAC system that’s over 10 years old or one with cracks and water damage (watch out for weird sounds too)

- A roof that’s old or damaged

- Toilets, showers or sinks that don’t work

- Sewer lines with bad clogs

- Leaks leading to water damage

- Loud, noisy neighborhood (or neighbors)

- Bulging, bowing or cracked foundation

- Broken appliances

Expert Advice Delivered Straight to Your Inbox

Our weekly email newsletter is full of practical advice you can easily apply to your daily routine so you can win with your money, relationships and career.

One Major Mistake to Avoid

You may have found a home that checks all the boxes we’ve talked about—and it’s clear of all those red flags. If so, that’s great!

But there’s still one major mistake you need to avoid as you’re looking for a place to live: buying too much house.

Because even if you buy a house that’s in tip-top shape with everything you want and more, you’ll be miserable if you can’t afford it. Trust me, that “dream” house you’ve got your eye on will become a nightmare if those monthly payments wipe out a major chunk of your paycheck.

How do you know if you can afford the house you’re looking at? You can afford it if your monthly payment on a 15-year fixed-rate mortgage is no more than 25% of your take-home pay. That payment includes homeowners association (HOA) fees, private mortgage insurance (PMI), property taxes and homeowners insurance.

If the house fits into your budget and checks all the other boxes I’ve talked about, go ahead and sign on the dotted line!

If not, then you need to pass and find a house that’s a better fit for your budget. Going back to the drawing board is no fun, especially if you’ve found a place you really like. But saying no to a place you can’t afford will save you a lot of heartache in the long run.

Struggling to find quality homes in your price range? Here’s a guide full of house hunting tips to make searching for a home a lot easier and less painful.

Besides, you don’t want your house to own you. You want to own it! The best—and only—way to make that happen is to choose a home that fits your current financial situation.

Get an Expert in Your Corner

Most homes you’ll look at, even brand-spanking-new ones, will have some flaws. But what gets tricky is knowing when to spend the money to fix an issue and when to negotiate a compromise with the seller. That’s why you need an experienced agent who can guide you through these rough patches and help you come up with a solution.

If you’re looking for a real estate agent with expertise, check out our RamseyTrusted program. From searching for solid homes to negotiating repairs, our RamseyTrusted agents will be able to walk you through your questions and work with you to find a home you (and your budget) love.

Connect with the top real estate pros in your local market today!

Read the full article here