There’s a relatively new kid on the block in the investing world that’s gotten popular over the last few years, and it’s called an exchange-traded fund (ETF).

Since you should never invest in anything you don’t understand, let’s walk through a breakdown of ETFs vs. mutual funds, so you can make the right call on which option is best for you.

Let’s get to the bottom of this debate!

ETFs vs. Mutual Funds: An Overview

Let’s start off with some basic definitions. When an investor buys a mutual fund, they contribute to a pool of money managed by a team of investment professionals. That team selects the mix of stocks, bonds, money market accounts and other options in the mutual fund.

So if a mutual fund is full of stocks, it’s called a stock mutual fund. What if it’s made up of bonds? Then it’s called a bond mutual fund. You get the idea!

On the other side, there are exchange-traded funds. Just like their name suggests, ETFs are funds that are traded on a stock market exchange. They’re basically a cross between mutual funds and stocks.

ETFs generally mirror a market index, like the Dow Jones Industrial Average or the S&P 500, by investing in most or all of the companies included on that index. For instance, if you invest in the S&P 500 ETF, you’ll own shares of all 500 stocks that make up the S&P 500 index.

Mutual Funds and Exchange-Traded Funds: Frequently Asked Questions

|

Mutual Funds |

ETFs |

|

|

What are they invested in? |

Depending on the type of mutual fund, a fund can invest in a wide variety of investments, such as stocks, bonds, money market accounts and more. |

ETFs generally mirror a market index, like the Dow Jones Industrial Average or the S&P 500. There are also ETFs that allow investors to buy shares of other types of investments: government and corporate bonds, commodities like gold and oil, or stocks from specific industries like technology or health care. |

|

Who manages the fund? |

In most cases, mutual funds are actively managed by a team of investment professionals that selects the mix of investments to include in the fund. |

ETFs usually have passive management. That means the investment pros in charge of the ETF pick the investments based on the index the fund is tracking. |

|

How are they bought and sold? |

Mutual fund transactions are made after the markets close because mutual funds set their prices once a day. You can set up automatic purchases of mutual fund shares. |

ETFs are bought and sold during the trading day as the price changes—just like single stocks. Because of that, you can’t automate purchases of ETF shares. |

|

How are they taxed? |

Mutual fund gains and dividends are usually taxed as capital gains or as ordinary income. |

Like mutual funds, ETF gains and dividends are taxed as capital gains or ordinary income. |

|

What are the costs involved? |

Because they’re actively managed, mutual funds often have higher maintenance fees, sales loads and expense ratios. |

While ETFs might have lower fees than mutual funds, many ETFs come with commissions and transaction costs every time you buy and sell shares. |

ETFs vs. Mutual Funds: How Are They Different?

So, what sets these two investment types apart? Their differences are critical to figuring out whether mutual funds or ETFs are right for you.

1. Mutual funds and ETFs are managed differently.

This is one of the main differences between ETFs and mutual funds: ETFs are managed passively (the fund just follows the market index) while mutual funds are managed actively by investment professionals. This keeps ETF fees low since there’s no team of managers selecting companies.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

The goal of having someone actively managing your mutual fund is to benefit from their expertise and beat average market returns. That makes mutual funds a little more expensive to own than ETFs, but the idea is you’ll benefit from stronger returns and from working with a financial advisor to help manage your portfolio. Plus, mutual funds are the best way to spread out (aka diversify) your investment risk.

2. Mutual funds and ETFs are bought differently.

ETFs are also designed to be bought and sold on stock market exchanges (like the New York Stock Exchange or the NASDAQ) during the trading day, allowing ETF investors to buy or sell in response to daily stock market swings. So basically, ETFs are mutual funds that can be traded like stocks. Because of that, you can’t set up automatic payments for ETFs—you have to buy them manually at a particular time for a particular price during the day.

Mutual fund transactions, on the other hand, are completed after the markets close. That’s because mutual funds set their price once a day. You can buy mutual funds from a broker, a financial advisor or directly from the fund itself. Plus, you can also set up automatic payments each month, which makes it easier to invest consistently over the long haul.

3. Mutual funds and ETFs perform differently.

Because most ETFs are index funds—which means they’re designed to mimic the performance of the stock market or a specific part of the stock market—you’ll only get returns that match whatever index the ETF is trying to match.

Most mutual funds don’t try to copy the market. Instead, they have a team of people picking stocks, and their goal is to outperform the stock market. And there are funds out there doing just that! You just have to work with an advisor who can help you find them.

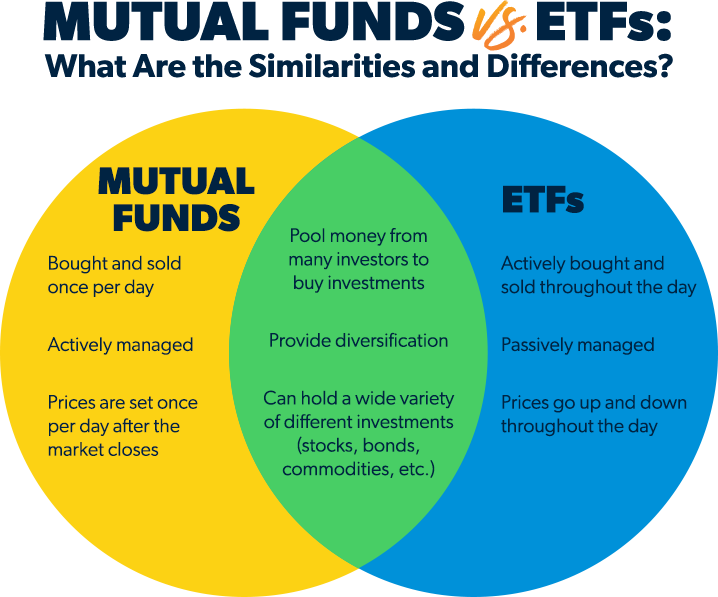

ETFs vs. Mutual Funds: How Are They Similar?

Despite all those differences, mutual funds and ETFS do have a lot of similarities that make both of them appealing investment options for long-term investors.

1. Mutual funds and ETFs are both less risky than single stocks.

Like mutual funds, exchange-traded funds give investors a chance to pool their money together so they can invest in a variety of different companies.

Because of that, both mutual funds and ETFs are less risky than investing in single stocks because they have a built-in layer of diversification. But the goal of most ETFs and mutual funds is a little different (we’ll get to that in a second).

2. Mutual funds and ETFs are both professionally managed.

Another thing mutual funds and ETFs have in common is they’re both professionally managed. After all, somebody has to pick and choose which investments go into the fund! Like we mentioned earlier, the difference is how they’re managed—mutual funds are actively managed while ETFs are passively managed.

3. Mutual funds and ETFs both offer a lot of investment options.

Like your favorite ice cream shop, mutual funds and ETFs both come in a wide variety of flavors. Do you want a fund filled with stocks or bonds? Do you want a fund that reflects the stock market? Or maybe one that invests in companies in a particular sector of the economy, like technology or health care? There’s probably a mutual fund or ETF out there for that.

ETFs or Mutual Funds: Which Is Best for You?

Since ETFs and mutual funds seem similar, it’s easy to think either, or both, would work well in your retirement plan. But we recommend mutual funds over ETFs for retirement investing. Here’s why:

1. Mutual funds are made for long-term investing.

To build wealth for retirement, you need to select your investments for the long term. Mutual funds are a great way to do this. Once you choose your funds, you want to leave them alone for 10, 15, 20 or more years—as long as they continue to perform well.

On the other hand, ETFs are traded like stocks (during the day, not after the markets close). That means investors can try to time the market, buying and selling ETFs for short-term gains and quick cash.

Let’s look at the numbers. A Fidelity study showed the impact of selling when the market gets rocky versus staying invested for the long haul. After the 2008 financial crisis, those who fought the panic, stayed put, and kept putting money away for retirement wound up tripling their wealth over the next 10 years. But those who decided to sell their investments or stop investing altogether missed out on that growth and fell behind.1

2. ETFs are not fee-free.

ETFs can be paid for in multiple ways: They can have operating costs—sometimes with transaction costs on top of that—or they can be in a fee-based account. Since most retirement investing is done through monthly contributions, those operation and transaction fees can quickly eat into your returns if you’re charged every month you add to your investment.

While ETFs usually carry lower fees than many mutual funds, you lose the personal touch that comes from working with a professional. Believe us, it helps to have an investment professional in your corner to help you pick and choose your investments.

3. Choosing the right mutual funds can help you outperform the market.

Using an ETF to mimic a market index (like NASDAQ or the Dow Jones Industrial Average) sounds like a great idea. Over the long term—30 years or more—the S&P 500 Index averages 10–12% growth.2 So, it’s a good plan, right? Hold up! In reality, there are better options. We don’t want you to settle for average. We want you to aim for what’s best.

Growth stock mutual funds can actually beat the stock market’s average. That’s the job of the investing experts who manage a mutual fund’s investments. And they know what they’re doing.

We recommend spreading your retirement investments equally among four types of growth stock mutual funds:

- Growth

- Growth and income

- Aggressive growth

- International

Spreading out your money over these four types of funds helps you diversify (fancy word for “not putting all your eggs in one basket”). Diversification helps you avoid the risks that come with investing in single stocks while using the power of the stock market to grow your retirement fund. The last thing you want is to have all your eggs in one basket!

When you’re choosing mutual funds, make sure to look for and invest in funds that have good track records—meaning you can see proven long-term growth in the stock market.

If you like the idea of passive investing—leaving an investment alone for a long time—then an index mutual fund (a fund made up of stocks within a particular market index) will allow you to “invest in” an index (or the companies within an index) without paying the common brokerage fees of an ETF. And you avoid the temptation to day-trade or jump out of the market when it dips.

When Does It Make Sense to Invest in an ETF?

So you get the picture by now: Go with mutual funds—not ETFs—inside your retirement accounts. But does that mean ETFs never have a place in your investing strategy? Not necessarily.

Let’s say you’ve maxed out your 401(k)s and IRAs and still want to keep investing. In that situation, you could open up a taxable investment account—like a brokerage account—and invest in stock ETFs that mirror the stock market (which means they average 10–12% annual growth over the long-term).

You see, unlike your retirement accounts, your taxable investment accounts are subject to capital gains taxes. And since a lot of stock ETFs have low turnover—which means the investments inside them aren’t switched around so much—you’ll usually pay less in capital gains taxes.

As long as you hold on to your ETF shares just like you would a mutual fund for long-term growth, it’s an option to consider!

Work With a Financial Advisor

You can find a knowledgeable financial advisor through the SmartVestor program’s nationwide network of investment professionals. They’re committed to educating and empowering you to make the best decisions possible for your retirement future.

Find your SmartVestor Pro today!

Read the full article here