The state of personal finance in America is full of anxiety and uncertainty. With prices rising and personal budget margins shrinking, Americans are struggling to adjust to what’s happening to their household’s bottom line—which has led to some not-so-optimistic outlooks about the future.

In this edition of the Ramsey Solutions State of Personal Finance report, we’re going back to basics to really get a pulse on where Americans are with their money. This includes looking at overall financial health as well as Americans’ difficult relationships with savings and debt.

We’ll start this edition of the State of Personal Finance with Americans’ perceptions of their overall financial outlook. It’s true that statistically fewer U.S. adults are struggling with money compared to the previous year, but that might only be a temporary reprieve.

When asked about how they feel about their personal finances, 32% of Americans said they’re either struggling or in crisis—about 83 million people. It’s a decrease from the spike of 37% in the previous quarter. However, a pattern has emerged from the data over the last twelve quarters. Americans seem to be on an emotional roller coaster with their finances each year—with negative emotions peaking in the third quarter and bottoming out in the first.

One possible explanation for this roller coaster is that the third quarter of any year brings financial challenges such as back-to-school spending, college tuition payments and the like. Another possible cause? Built-up anxiety from overspending during summer vacations and other fun-in-the-sun activities.

As for the dips in the first quarter, the new year has historically been a time of optimism. According to Pew Research, of the people who make New Year’s resolutions, 61% resolve to improve their finances.1 So looking ahead to the possibilities of a new year may help minimize feelings of financial struggle.

Even though the number of Americans in crisis went down quarter to quarter, the overall trend continues to tick upward from the second quarter of 2021, when the fewest people (21%) said they were struggling or in crisis with their money.

Over Half of Americans Are Happy With Their Finances

Despite the financial roller coaster, 53% of Americans are happy with their current financial situation, with men much more content than women (63% vs. 44%). Millennials and Gen Z are tied for the happiest generation (60%)—which is interesting because both generations, in the popular culture, are often depicted having a harder time getting ahead financially. Meanwhile, Gen X takes the bottom spot (44%), followed by baby boomers (51%).

Americans’ Budgets Squeezed As Prices Rise

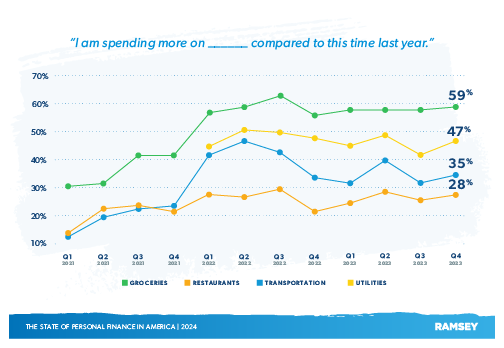

According to the responses from our survey, the main driver of personal finance-related stress appears to be rising costs thanks to rapid inflation. The cost of groceries, in particular, has gone up 25% since 2019. And over a third of Americans (38%) are finding it financially difficult to provide food for their household.

The evidence is in the long-term percentages. Over the last three years, the percentage of Americans who have said they’re spending more on groceries than the previous year has steadily increased from 31% at the start of 2021 to 59% in the fourth quarter of 2023—an overall increase of 90%.

The Current Challenge of Saving Money

With almost 60% of Americans saying that the cost of everyday life is going up, it’s no surprise that savings has suffered. Increasing prices have made margins in budgets smaller and smaller, which makes putting money away for tomorrow harder. When someone is faced with the choice of putting money away or eating, there really isn’t a choice.

While not all households are in such a dire situation, the numbers show many Americans lack confidence in and are unhappy about their savings situation.

Less Than Half of Americans Are Happy With Their Savings

The pinch to make ends meet has left many Americans less than satisfied with their savings. About 44% of Americans said they are happy with the amount of money they have saved—be it for big savings goals like retirement or short-term goals like an emergency fund or sinking fund. This number coincides with only half of Americans (53%) having at least $1,000 on hand in savings.

The generation most happy about their current savings amount is Gen Z, but even that’s just over half (52%). Gen X is the least happy, with about 35% satisfied with their savings. Breaking with the stereotypes of younger generations, perhaps Gen Z is optimistic because they have more years left in the workforce to save compared to other age groups. Or conversely, they might also underestimate the amount of savings they should have, as only 33% of Gen Z said they have at least $1,000 socked away.

Most Americans Feel Behind on Their Retirement Savings

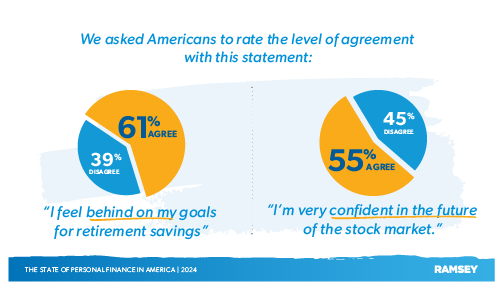

Whether they’re happy about the current state of their savings or not, most Americans (61%) don’t feel like they’re keeping up with their retirement savings goals.

Breaking the data down further, more of the younger generations feel anxious about retirement—even though they’re further away from retirement and still have time to save. A majority of both Gen Z and millennials (70% for both) said they feel behind on

their savings. Young people feel that, with the cost of living going up and with many of them saddled with student loan debt, setting aside money for retirement is extremely difficult. However, this might also be a question of not having their spending priorities in order (eating at home vs. eating out, cutting back on travel, etc.).

Half of Americans Are Confident in the Future of the Stock Market

Historically, the S&P 500 shows the stock market averages about 10–12% growth over the long term.2 In other words, though the stock market does experience short-term ups and downs, the overall trend remains consistent. And yet, only 55% of Americans said they’re very confident in the future of the stock market.

Older generations are less likely to trust the stock market, with only 46% of baby boomers and 49% of Gen X expressing confidence. There’s a similar but higher level of confidence between millennials (67%) and Gen Z (64%).

Unexpected Money Emergencies Are Real and More Common Than We Think

Savings challenges aren’t just impacting Americans’ long-term savings goals like retirement. They’re also impacting people’s ability to handle financial emergencies.

Saving for emergencies is a must because emergencies eventually happen—whether that’s a car repair, a leaky roof, a medical bill or even a job layoff. Having 3–6 months of expenses stocked away gives you peace of mind that life’s little mishaps will be just that and not a catastrophic event that can turn your whole world upside down.

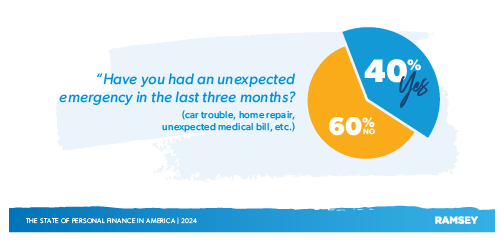

40% of Americans Had an Unexpected Money Emergency in the Past 3 Months

Over one-third of Americans (40%) said that they had an unexpected money emergency come up in the last three months.

Getting more into the data, annual household income doesn’t appear to be a factor in how often a household experiences an emergency. People of all income demographics were just as likely to experience an emergency (around 40% in each income category). It just goes to show that unexpected money emergencies happen to everyone.

25% of Americans Had an Unexpected Money Emergency Over $1,000

Of those U.S. adults who experienced a money emergency in the last three months, 25% of them said it was an expense over $1,000. One in 10 said that their emergency expenses were over $5,000.

And the emergency was twice as likely to be more than $10,000 for those making at least $100,000 (19%).

Breaking up the data by generation, Gen Z was the most likely to have a money emergency over $1,000 (75%). But millennials weren’t too far behind, with 70% saying the same. More men than women had expensive money emergencies as well (71% vs. 56%).

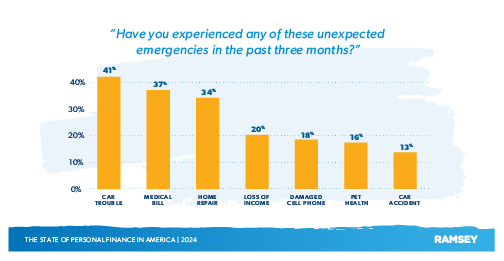

Car Trouble Is the Top Cause of Money Emergencies

As we said in the beginning of this section, the causes of unexpected money emergencies can vary widely depending on income and lifestyle. But the most common emergency for all Americans is car issues (41%)—followed by medical bills (37%) and home repairs (34%).

Cars being at the top of the money emergency list makes sense considering that the average age of cars and light trucks in the U.S. is 12.6 years—and older cars often mean more maintenance issues.3 Not to mention that the cost of buying a newer car is expensive thanks to inflation, higher interest rates, supply chain issues, and other factors.

Debt Continues to Hinder Financial Peace

All the data points we’ve highlighted in this study have one big thing in common (besides being about personal finance): the issues they reveal are made worse by debt.

For example, 38% of those with debt said they’re struggling or in crisis with their finances, while only 22% of those who are debt-free said the same. In another example, 37% of people with debt said they’re happy with their savings as opposed to 56% of those who are debt-free.

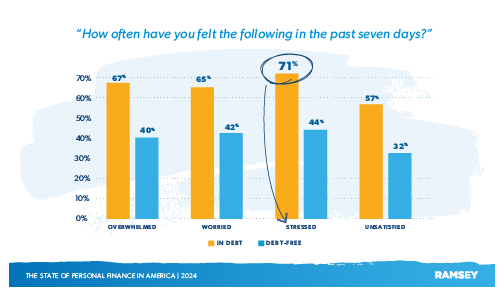

People Who Are in Debt Are More Likely to Feel Stressed

Nobody likes having a monkey on their back, but the burden of debt puts the debtor under a ton of pressure to make their payments. How long can they keep their heads above water before an emergency happens?

Given the immense pressure that comes with having debt, it comes as no surprise that Americans in debt are more likely to feel overwhelmed, worried and stressed than those without debt. And people with debt are almost twice as likely to feel unsatisfied with life—which is understandable when your money flies right out your door as soon as you get it.

3 in 4 Americans Have Been in Debt at Some Point in Their Lives

In today’s culture, debt is pervasive—seeping into just about every monetary transaction. More and more retailers (even grocery stores) are offering buy now, pay later (BNPL) programs for purchases. Car payments are considered a normal part of life. And credit card offers seem to drop into our mailboxes daily.

Because the culture promotes debt as a means to get ahead, 73% of Americans have had debt at some point in their lives (credit cards, auto loans, student loans, mortgages, etc.). Americans today owe $1.13 trillion in credit card debt, $12.61 trillion in mortgages, $1.61 trillion in car loans and $1.6 trillion in student loans.4

Unfortunately, Americans’ relationship with debt begins very early in life. In fact, the median age at which people first go into debt is 23. And two-thirds of U.S. adults are in debt by age 30.

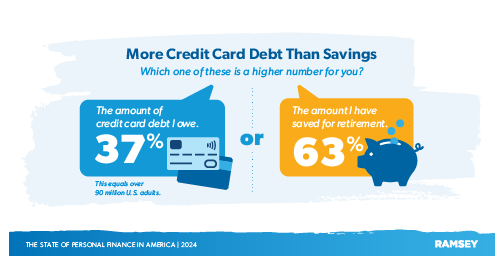

37% of Americans Have More Credit Card Debt Than Retirement Savings

Debt is easy to get into, but Americans find saving for retirement much more difficult. Over one-third of Americans (37%) said they have more credit card debt than retirement savings—that’s more than 90 million U.S. adults.

Keep in mind that we only asked respondents about credit card debt. Other kinds of debt like auto loans, student loans and home equity lines of credit (HELOCs) might also be—and more than likely are—in play.

Conclusion

Americans are struggling to keep up with the rising cost of living, and bad money habits aren’t making things better. Though prices are rising, hope is far from gone. But it will require effort and huge lifestyle changes on the part of the American people to get themselves out of the financial mess they’re in.

Getting out of debt remains the key to achieving financial stability. Once all those unnecessary payments are gone, it’s easier to save for both the emergencies of today and the retirement plans of tomorrow. Americans also must learn to live within their means and break the habit of spending money they don’t have on things they don’t need. All this begins with a good plan—specifically a monthly household budget that makes the most of each family’s income.

About the Study

The State of Personal Finance is a quarterly research study conducted by Ramsey Solutions with 1,010 U.S. adults to gain an understanding of the personal finance behaviors and attitudes of Americans. The nationally representative sample was fielded from March 13 to 20, 2024, using a third-party research panel.

Read the full article here