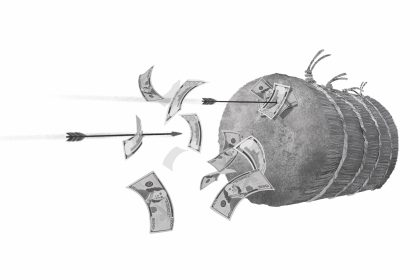

As the holiday season approaches, the excitement of festivities, gatherings, and gift-giving often comes with a looming concern of financial strain. The key to enjoying this time without compromising your financial health lies in refreshing your budget. A well-thought-out budget allows you to partake in the joy of the season while maintaining financial stability. Here’s a guide to help you with refreshing your budget and navigate the holiday season with confidence.

Assess Your Current Financial Situation

Before diving into holiday preparations, it’s crucial to understand your current financial standing. Take a comprehensive look at your income, expenses, debts, current budget, and savings. This assessment will provide a clear picture of your available funds and help you identify areas where you can cut back. Knowing your financial baseline is the first step toward making informed spending decisions.

Set a Holiday Budget

Creating a dedicated holiday budget is essential for keeping your finances on track. Start by listing all potential holiday expenses, including gifts, decorations, travel, food, clothing, and entertainment. Be realistic about what you can afford and set spending limits for each category. Remember, do not spend what you don’t have. Each spending limit needs to be realistic and shouldn’t need to factor in credit cards. Now if you do use credit cards it should only be what you can comfortably pay off at the end of the month. A clear holiday budget acts as a financial compass, guiding your spending decisions and helping you avoid overspending.

Prioritize Your Spending

With a plethora of holiday activities and expenses, it’s important to prioritize what matters most. Decide which traditions and events are most meaningful to you and allocate funds accordingly. Consider scaling back on less significant expenses to ensure you can fully enjoy the aspects of the holiday season that bring you the most joy. Prioritizing spending helps you focus on what truly matters, making your holiday experience more fulfilling.

Embrace Creative Gift-Giving

Gift-giving is a beloved holiday tradition, but it doesn’t have to break the bank. Consider alternative gift options that are both thoughtful and budget-friendly. Handmade gifts, personalized experiences, or acts of service can often be more meaningful than expensive store-bought items. Additionally, organizing a Secret Santa or gift exchange can reduce the number of gifts you need to purchase, easing financial pressure.

Take Advantage of Sales and Discounts

The holiday season is rife with sales and discounts, offering opportunities to save money on your purchases. Plan your shopping around major holiday sales to take advantage of significant discounts. Use apps and websites that track deals and offer cashback to maximize your savings. You can also check the websites of your local stores for upcoming sales. By planning your purchases strategically, you can make your budget further.

Monitor and Track Your Spending

Keeping a close eye on your spending is crucial to staying within your budget. Using apps that have a budgeting feature or a simple spreadsheet to track your expenses and monitor your progress against your holiday budget. Regularly reviewing your spending helps you stay accountable and make adjustments as needed. This proactive approach prevents surprises and ensures you maintain control over your finances.

Plan for Post-Holiday Expenses

While it’s easy to focus on holiday spending, it’s important to plan for post-holiday expenses as well. Anticipate any upcoming bills or financial obligations that may arise in the new year and set aside funds to cover them. This foresight prevents financial stress and allows you to start the new year on a solid financial footing.

Reflect and Adjust

After the holiday season, take time to reflect on your budgeting and spending experience. Consider what worked well and what could be improved. Use this reflection to adjust your budget and financial strategies for the future. Learning from your holiday budgeting experience can help you develop better financial habits and prepare for future holiday seasons.

Enjoying Festivities Without Financial Stress

Refreshing your budget for the holiday season is an empowering way to enjoy festivities without financial stress. By assessing your financial situation, setting a realistic budget, and prioritizing your spending, you can embrace the holiday spirit with peace of mind. Remember, the true essence of the season lies in the moments shared with loved ones, not in the money spent. With a thoughtful approach to budgeting, you can create lasting memories and enter the new year with financial confidence.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.

Read the full article here