With online bill payment and mobile wallets on the rise, consumers are relying less on paper checks. Those who do still write checks are likely shocked by the price when it’s time to reorder.

You can find the best deal when ordering checks by comparing what your bank will charge you with the price you’ll pay online at various third-party check printers. You may find these companies charge considerably less than your bank charges for checks (and might offer cooler designs). When considering a third-party printer, however, it’s important to take some basic precautions.

Companies that sell personal checks

A quick survey of prices that non-banks charge for standard blue checks finds that you’ll likely pay between 4 and 25 cents for single checks. Likewise, you’ll pay between around 6 and 30 cents for duplicate checks. Duplicate checks are those that have a thin piece of paper behind them that acts as a carbon copy.

Single checks

| Company | Number of checks in one box | Cost, 2 boxes | Cost per check |

|---|---|---|---|

| Sam’s Club | 240 | $17.38 | $0.04 |

| Checks.com | 80 | $11.90 | $0.07 |

| Costco | 125 | $20.22 | $0.08 |

| Promise Checks | 100 | $15.90 | $0.08 |

| Vistaprint | 150 | $24.00 | $0.08 |

| Walmart | 240 | $19.62 | $0.08 |

| Checks in the Mail | 100 | $38.25 | $0.19 |

| Checks Unlimited | 80 | $29.98 | $0.19 |

| Chase Bank (provided by Deluxe) | 80 | $40.00 | $0.25 |

Duplicate checks

| Company | Number of checks in box | Cost, 2 boxes | Cost per check |

|---|---|---|---|

| Sam’s Club | 165 | $18.85 | $0.06 |

| Checks.com | 80 | $13.90 | $0.09 |

| Walmart | 120 | $22.56 | $0.09 |

| Costco | 100 | $20.70 | $0.10 |

| Vistaprint | 150 | $30.00 | $0.10 |

| Promise Checks | 80 | $21.90 | $0.14 |

| Checks in the Mail | 100 | $44.65 | $0.22 |

| Checks Unlimited | 80 | $39.98 | $0.25 |

| Chase Bank (provided by Deluxe) | 80 | $48.00 | $0.30 |

Prices retrieved online Feb. 28, 2024

The cheapest provider we could find was Sam’s Club. The Walmart-owned buying club sells single checks for about 4 cents each, far less than the price you’ll pay ordering them through Chase Bank’s check-reordering vendor.

Of course, price isn’t everything; you don’t want to give your checking account information to a sketchy, fly-by-night operation. If you’ve never heard of the site you’re thinking of ordering from, check on them via a Better Business Bureau (BBB) search before you give up any sensitive information.

Steps to get cheap personal checks

- Check if your bank offers free checks. Some banks offer free standard checks to account holders, which can include the first book of checks or subsequent refills. Financial institutions that offer free standard checks to their customers or members include Ally Bank and Navy Federal Credit Union.

- Look online for deals and promo codes on checks. You may be able to save money by finding deals for discounts or free shipping when ordering checks online. Sites that often list such offers include CouponCabin and RetailMeNot.

- Order your checks in bulk. This may be worthwhile if the price per check is lower when you order a larger quantity. What’s more, ordering basic, standard designs will likely be cheaper than ones with multicolored, custom images.

- Go with economy shipping. If the seller offers different shipping speeds and you don’t need expedited shipping, opting for the longest shipping time will likely save you a good deal of money.

The safe places to shop

If going outside your bank to get checks makes you nervous, keep in mind that banks typically don’t print checks. They send them to a third-party printer, such as Deluxe or Harland Clarke, so all you’re really doing is cutting out a middleman.

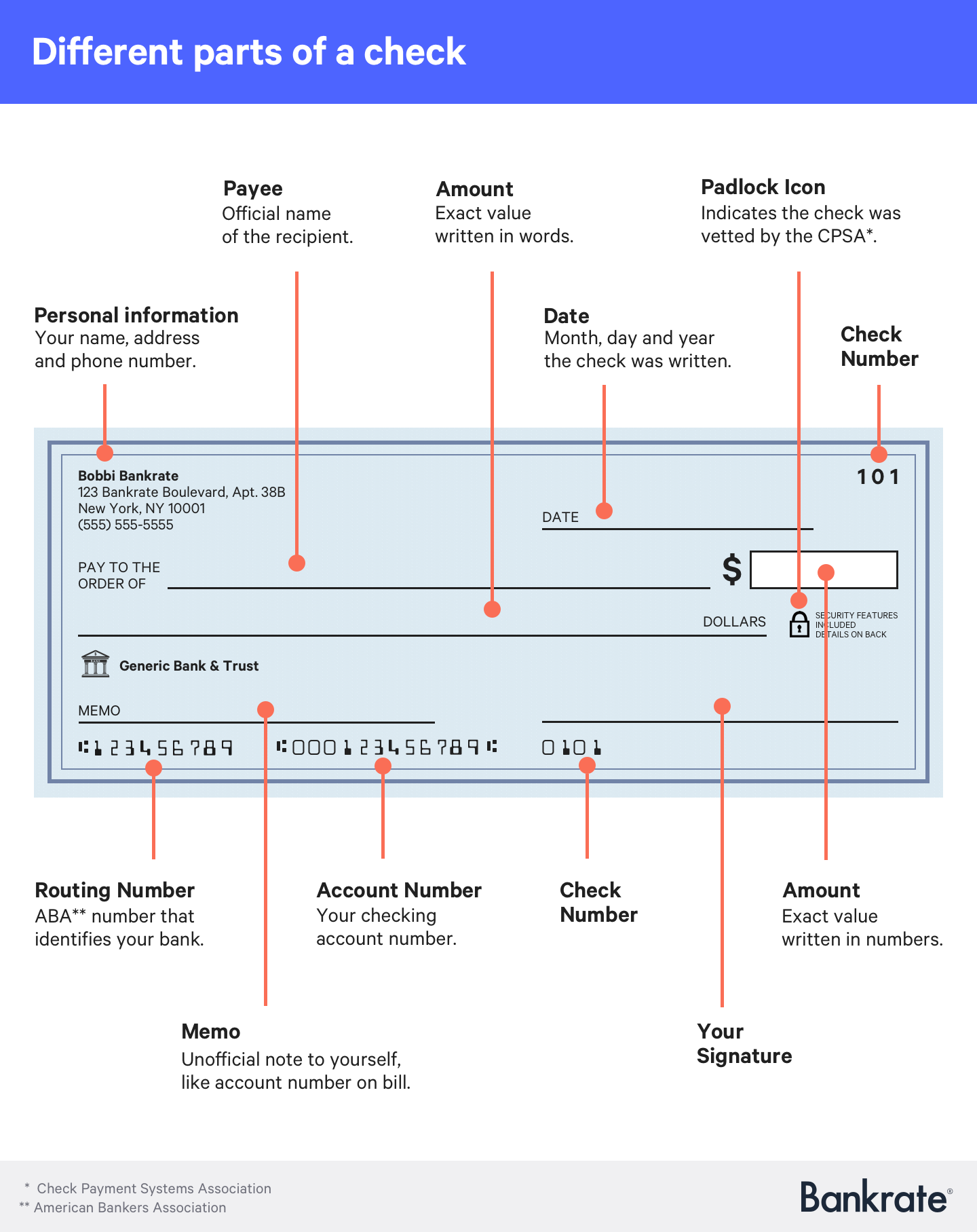

One easy way to tell whether you’re ordering checks from a reputable company whose products meet basic security standards is to look for a little padlock icon on the right side of their checks under the “amount” box. If it’s there, you know the check and the company itself have been vetted by the Check Payment Systems Association (CPSA).

“The padlock icon is a way of letting people who are handling checks know that the checks that are in their possession have at least a minimum number of security features that would protect against alteration of a check and duplication of a check,” says Steven Antolick, CPSA executive director.

The website of the Check Payments System Association (CPSA), a nonprofit trade association, provides a list of all of its authorized printers. Checks in the Mail and Deluxe, which are merchants in Bankrate’s table above, are listed on the CPSA website as authorized printers.

Everything you need to place a check order

If you decide to take the plunge, everything you need to order new checks online can be found on one of your old checks (or a temporary check, if it’s a new account). This information may include:

- Your checking account number

- Your bank’s routing number, which you can also find on the bank’s website

- The check number on your last check, so you know which number your new checks should start with

- In some states, the date you opened the account

You’ll also want to double-check your order before making it final. While printers typically verify your account details with the bank before printing, checks with the wrong account information on them aren’t very useful.

Security is the most important feature

If you’re going to spend more than the bare minimum on a check, it should be on check-safety features, says Magnus Carlsson, a product manager with the Federal Reserve Bank of Boston.

“Checks are the payment method with the most fraud,” Carlsson says. “So anything you can do to have more security is a big thing.”

Security features such as additional hard-to-copy microprint, hologram foil, heat sensors and hard-to-duplicate watermarks can increase the cost of checks.

The cost of added check security is probably more manageable for consumers, who write checks occasionally, than it is for businesses that write thousands or even millions of checks per year. Compare your costs with the potential fallout from fraud, Carlsson says.

Bottom line

Ordering checks can be pricey, and you may save a good deal by going with an online printer instead of your bank. It’s important to research any third-party vendor before giving them your checking account information. Your best bet would be a reputable company that offers checks with important security features.

– Claes Bell, CFA contributed to a previous version of this article.

Read the full article here

Trending:

Trending: