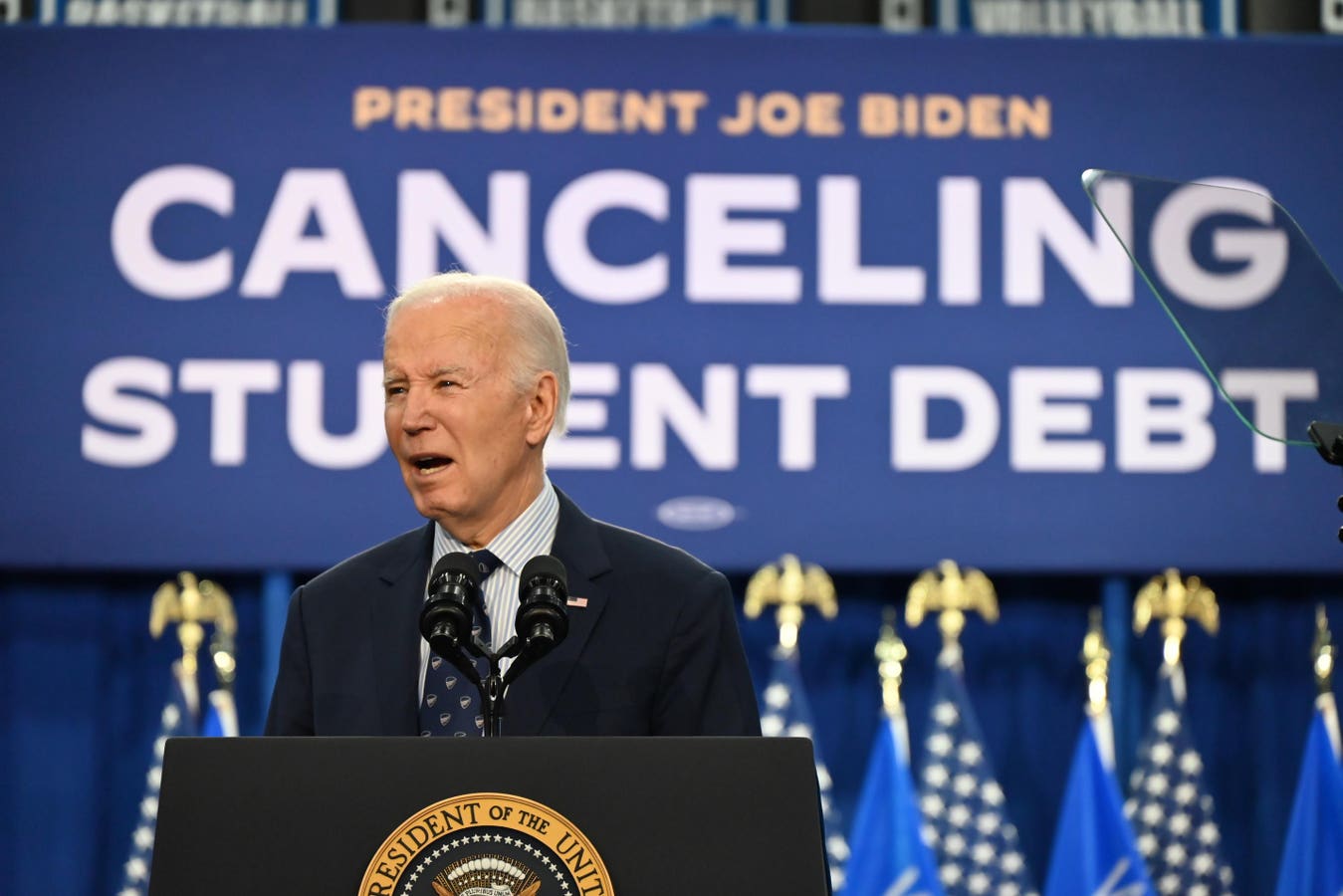

President Joe Biden unveiled a broad new student loan forgiveness plan this week that could provide relief to up to 30 million borrowers.

“I said I wouldn’t back down from using every tool at our disposal to get student loan borrowers the relief they need,” Biden said in a statement on Monday. “That’s why today we’re announcing new plans that, if implemented, would cancel student debt for millions more.”

The new loan forgiveness initiative, which is distinct from Biden’s initial student debt relief plan that was struck down by the Supreme Court, focuses on several categories of borrowers. One such category involves borrowers who have been harmed by what Biden characterized as “runaway interest” — a significant problem for many people struggling with student debt.

Here’s how the new initiative would forgive student loan interest.

Student Loan Forgiveness For Capitalized Interest

It is not uncommon for borrowers to owe much more than they originally borrowed, often despite being in repayment for many years. The Biden administration is targeting these borrowers for student loan forgiveness because of the widespread impacts of this phenomenon.

There are several reasons for broad interest-related student loan balance increases. First, unsubsidized federal student loans start accruing interest immediately, right after disbursement, even while the borrower is in school. Only subsidized federal student loans freeze interest during in-school enrollment periods. Since most federal student loans are unsubsidized, that means that many borrowers start off owing more than they originally borrowed as soon as they enter repayment due to interest that accrued while they were in school.

Interest can continue to accrue during periods of non-payment for both unsubsidized student loans and, in some cases, subsidized student loans. Interest accrues during grace periods, which are typically a six-month periods after graduation during which no payments are due. Interest also can accrue during forbearances and some deferment periods, which are programs to temporarily postpone repayment. Advocacy groups for borrowers have accused loan servicers of engaging in so-called “forbearance-steering” practices for years, whereby borrowers notifying their servicers that they were having trouble affording their payments would be placed in a forbearance rather than a more affordable repayment plan. Forbearances can have profound interest consequences over time, resulting in periodic interest capitalization (where the accrued interest gets added to the loan principal, resulting in interest accruing on interest).

In addition, borrowers who have been repaying their student loans under income-driven repayment plans can also experience significant balance growth due to interest accrual and capitalization. IDR plans base a borrower’s monthly payment on their income and family size, with the possibility of student loan forgiveness after 20 or 25 years. But there’s no requirement that the monthly payments be high enough to cover accruing interest. As a result, borrowers in IDR plans can experience negative amortization — a growing loan balance, even while they make payments. While borrowers can eventually receive student loan forgiveness through IDR plans, that forgiveness could be a taxable event. And a higher balance due to capitalized interest could result in even higher taxes.

The new Biden student loan forgiveness plan targets relief to borrowers who have experienced significant interest accrual and capitalization.

How Student Loan Forgiveness For Capitalized Interest Will Work

Biden’s new student loan forgiveness plan would cancel student loan interest “for all borrowers who have accrued or capitalized interest on their loans since entering repayment,” according to new guidance released by the Education Department.

“All borrowers would be eligible for this debt cancellation,” associated with interest capitalization, says the guidance. The amount of student loan forgiveness, however, would depend on the borrower’s circumstances.

“Low and middle-income borrowers enrolled in the SAVE Plan or other Income-Driven Repayment plans would be eligible for their entire interest balance since entering repayment to be cancelled,” says the guidance. Qualifying borrowers would need to make $120,000 or less in individual or married-filing-separately income, $180,000 or less as a head of household, or $240,000 or less as married-filing-jointly.

Borrowers who don’t meet these income requirements would still be eligible for up to $20,000 in student loan forgiveness associated with interest capitalization.

Key Details On Biden’s New Student Loan Forgiveness Plan

Capitalized interest is not the only basis for student loan forgiveness under Biden’s new debt relief plan. The program will also provide four other grounds for loan cancellation including current eligibility for existing student loan forgiveness plans, being in repayment for more than 20 or 25 years, attendance at “low-financial-value programs,” and financial hardship.

The program is not yet available, so borrowers cannot apply for student loan forgiveness quite yet. The Education Department is expected to publish the final regulatory language next month, and a period of public comment will follow. The program could be up and running by the fall. However, there will almost certainly be legal challenges, which could block implementation.

Read the full article here