Gold’s rush to a new all-time high of $2347.58 an ounce earlier today, up $97.50 (4.3%) in a week is starting to split opinions about what comes next with optimists seeing $3000/oz within reach while pessimists believe there’s a correction coming.

The prize for biggest bull in room is shared three seasoned players in the game of gold-price forecasting with Citi, an investment bank, Rosenberg Research and Yardeni Research all tipping a continued rise to $3000/oz.

Offsetting that enthusiastic view are warnings that forces such as a strong U.S. dollar and the pace of future interest rate cuts could trigger a gold price fall.

The loudest warning that the recent upward surge in the gold price might have reached its limit came from Bob Parker, a senior adviser with the International Capital Markets Assocation in an interview carried by the business television channel CNBC.

Parker said fundamental factors suggested the upside for gold was minimal, leaving it vulnerable to a setback after its $530/oz (29%) rise over the past six months.

Multiple factors have been driving gold higher, including private buyers seeking a safe haven from volatile financial markets, and central banks increasing their exposure to an asset separate from the U.S. dollar and other currencies.

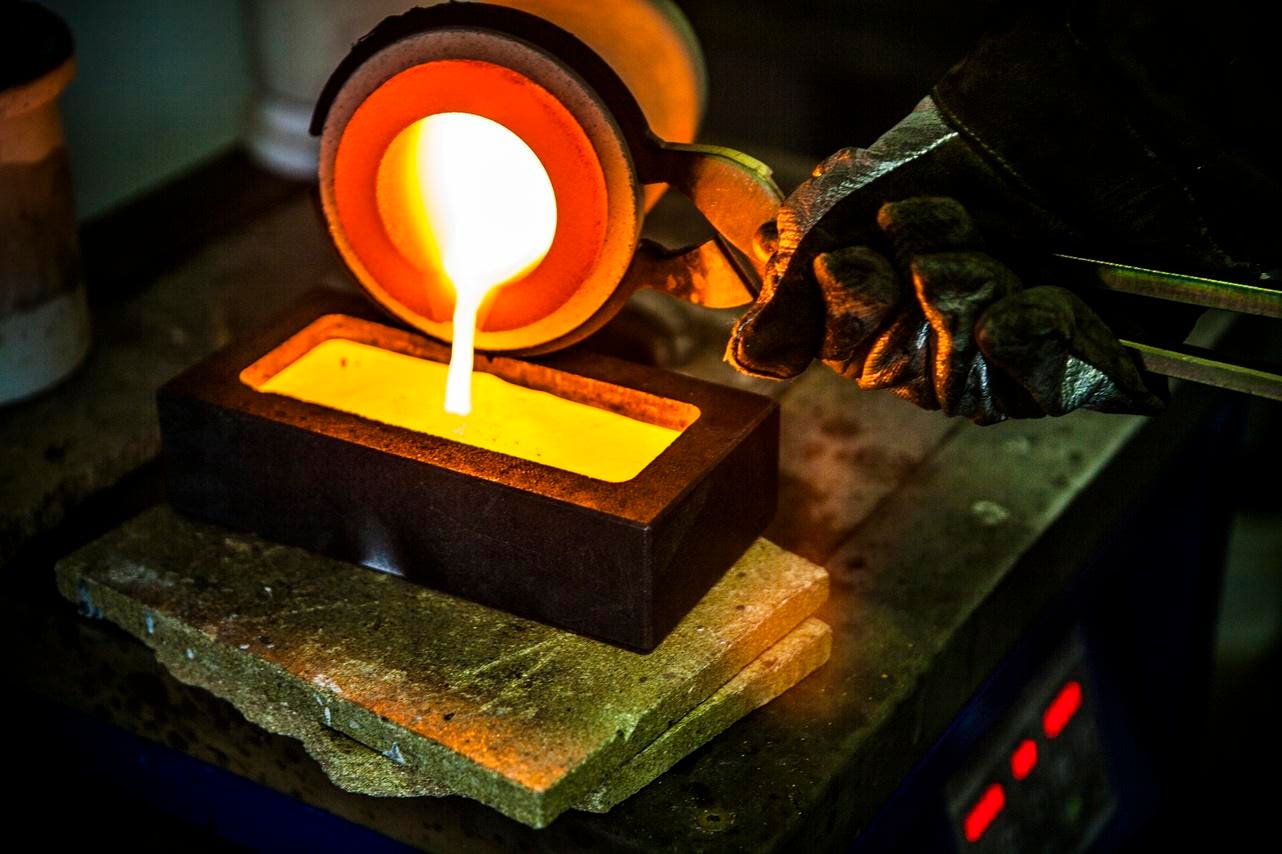

The private gold rush has gone as far as Costco, a big discount retailer, offering one ounce gold bars alongside breakfast cereal, shoes and smartphones.

Central bank buying is a more potent factor in the gold market because the appetite of the banks for gold appears to be running at a near record level for the third successive year with China’s central bank adding 160,000 ounces to its reserves in March, the 17th straight month of buying.

If central banks continue buying they could eclipse the record set in 2022 when they collectively acquired 1081.9 tons followed by 1037.4 tones last year.

Despite concern about a possible gold fall after its recent record-breaking run banks such as Citi see room for the rally to roll on.

In a research note sent to clients late last week Citi said it had lifted its price targets for gold and silver over the next three months to $2400/oz and $28/oz respectively.

Bull Case Scenario

“We further lift our six-t0-12-month topside levels towards our bull case scenario of $3000/oz (for gold) and $32/oz (for silver),” Citi said.

The bank said it was not the weakening U.S. dollar driving gold but the prospect of lower interest rates, combined with flat demand for alternatives, geopolitical hedging, and financial buying to catch up with robust physical demand, working in sync to push the bullion complex higher.

Read the full article here