Leigh, a 27-year-old in Maryland, first saw her parents’ income statements when she was a child and quickly realized something wasn’t adding up. Though her parents were trying their best to be financially responsible, their bills were too high compared to their unstable income, and they were spending too much on everyday purchases and shopping splurges.

She had always been good with numbers, so Leigh, who requested her last name be withheld for privacy reasons, made a budget for her nine-person household when she was 13 years old. Despite that, it wasn’t until she was an adult that she finally stopped imitating some of her parents’ bad money habits.

“I do believe that my parents try their absolute best,” Leigh says. “They didn’t have the personal finance foundation because their parents didn’t teach them. It’s a very heavy generational issue. One person needs to realize, ‘This is a problem, I can learn,’ and then you can literally change the rest of the generations beneath you.”

Today, many young Americans are navigating adulthood using only the financial guidance they received from their parents, which poses a significant challenge for the millennial and Gen Z adult children of Gen Xers and baby boomers. These adult children often encounter outdated or inadvisable financial advice, if any at all.

For example, baby boomers are less likely than younger generations to move their short-term savings to an online savings or money market account, according to Bankrate polling.

Despite the benefits of a high-yield savings account, baby boomers cite feeling comfortable with their current financial institution (50 percent) and preferring having access to a local branch (53 percent) as reasons for not switching, according to Bankrate polling. Additionally, 39 percent of those baby boomers are worried about the security of their money, despite the fact that most online savings accounts are FDIC-insured.

Without actionable advice from their parents, young adults are often turning to social media platforms like Facebook and TikTok to fill in the gaps. But social media, too, can be a minefield of misinformation. Wherever they turn for help, it can be a struggle for young Americans to find personal finance information they can actually use in today’s economy.

Young Americans are frequently warned to be careful about following financial advice that they see on social media, but as today’s challenging economy rewrites the rules for building wealth, Gen Zers and millennials’ finances are also at risk when they listen to those who they likely respect most: their parents.

— Sarah Foster, Bankrate Economic Analyst

Bankrate’s insights on young adults and financial advice

- Many Americans aren’t learning financial topics from their parents. 30% of U.S. adults say their parents didn’t teach them how to build financial wealth, including 21% of Gen Zers (ages 18-27), 28% of millennials (ages 28-43), 33% of Gen Xers and 35% of baby boomers, as of December 2023.

- The economy impacts younger Americans’ views on money. 30% of U.S. adults say, due to the current economy, building financial wealth is harder for them than it was for their parents when they were their age, including 32% of Gen Zers and 41% of millennials, as of December 2023.

- Facebook is more popular for money advice. 21% of Gen Zers who received financial advice in 2023 got it from social media influencers on Facebook, making it the most popular network among that generation. 19% received financial advice from social media influencers on Instagram, 17% received advice from TikTok, 12% received advice from X (formerly known as Twitter) and 12% received advice from another social media platform.

Baby boomers’ parental guidance on money can be outdated

More than half (58 percent) of Gen Zers got financial advice from friends and family in 2023, according to Bankrate’s survey on financial advice. If you’re a Gen Zer, you may have heard the following pieces of advice from older family members, neighbors or colleagues:

- Avoid taking out lines of credit — always pay in cash instead.

- Buy a house immediately because renting is just throwing your money away.

- Don’t switch jobs for a better salary — stick it out at one company for as long as you can.

This advice is typically less relevant in today’s economy than when baby boomers or Gen Xers were young. Americans trying to build savings, pay off debt and build wealth (like maximizing their savings or buying a house) are doing so under a different economic climate than what their parents experienced as young adults in the 20th century. Unlike many of their parents, young adults today are facing a housing crunch and burdensome amounts of student loan debt.

By many standards, the U.S. economy looks different today than it did back when Gen Zers’ and millennials’ parents were young. That isn’t to say that baby boomers and Gen Xers didn’t face their own unique set of financial challenges. It’s just that the playing fields might look different, thus requiring modernized financial advice.

— Sarah Foster, Bankrate Economic Analyst

Although the majority of Gen Zers and millennials say they’ve learned how to build financial wealth from their parents, they’re also the most likely generation to say they’re having to consider (or have pursued) different means of growing wealth than their parents did due to the economy, according to a separate December 2023 Bankrate survey:

- 21 percent of Gen Zers (compared to 35 percent of baby boomers) say their parents didn’t teach them how to build financial wealth.

- 32 percent of Gen Zers (compared to 19 percent of baby boomers) say building wealth is harder for them than it was for their parents when they were the same age, due to the economy.

- 30 percent of Gen Zers (compared to 15 percent of baby boomers) are having to consider (or have pursued) different means of growing wealth than their parents did when they were the same age, due to the economy.

Source: Bankrate

Like other older Gen Zers and millennials, Leigh grew up before the use of social media was ubiquitous — she had to Google information on saving and budgeting. Today, social media is filling in the gaps in young Americans’ personal finance knowledge.

Around half (49 percent) of Gen Zers who received financial advice in 2023 heard it from social media influencers last year, according to Bankrate’s survey on financial advice, making it the most common way of getting financial advice among young Americans, after family or friends. Most commonly, they’re getting advice from influencers on Facebook (21 percent), Instagram (19 percent) or TikTok (17 percent):

We asked: From which, if any, of the following did you get financial advice in 2023

| Generations who received financial advice in 2023 | Social media influencers on Facebook | Social media influencers on Instagram | Social media influencers on TikTok | Social media influencers on X (Formerly Twitter) | Social media influencers on another platform | Total who get advice through social media influencers |

|---|---|---|---|---|---|---|

| Source: Bankrate | ||||||

| Gen Zers | 21% | 19% | 17% | 12% | 8% | 49% |

| Millennials | 21% | 19% | 15% | 13% | 13% | 43% |

| All U.S. adults | 14% | 12% | 9% | 8% | 8% | 30% |

TikTok, in particular, has both millions of videos and a well-crafted algorithm that can suck viewers in for hours at a time. What it doesn’t have is any way of labeling creators based on credibility or experience, according to Michael Spikes, a lecturer and program director at Northwestern University who specializes in media literacy.

TikTok’s format “flattens content,” Spikes says, meaning all its content is unverified and presented to viewers without context. Unlike some social media platforms that verify content creators, TikTok’s lack of a verification system means that someone aimlessly scrolling has no immediate way of knowing if the creator is credible or not.

“We use these (platforms) primarily on mobile devices,” Spikes says. “They really emphasize getting in and finding the answer, or finding the thing that you were hoping to get — such as being entertained — really, really, quickly. The incentive is for us to stay on it for a longer period of time, rather than us being more informed.”

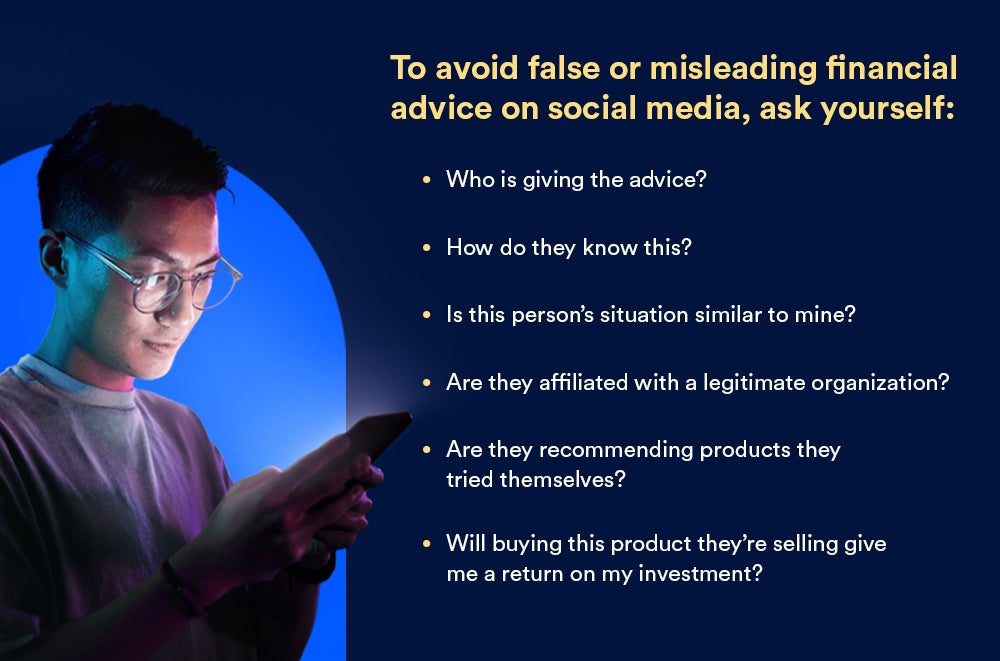

To avoid misinformation when looking for personal finance information online, consider the source and their motivation, Spikes says. If their advice or the product they’re recommending seems too good to be true, it likely is.

“Remember the ultimate test for sniffing out poor financial advice on social media: There’s no get-rich-quick scheme to growing wealth,” Foster says. “Don’t throw all your eggs in one basket. Diversify your investments, and keep a long-term perspective. And before you begin investing, be sure you have enough cash stashed away to cover an unexpected expense.”

FAQs

-

When looking for credible sources, consider those affiliated with an organization (such as a government agency, university or well-known publication) that explain how they got their data and what their possible conflicts of interest are.

-

Not all advice on TikTok is bad, but it can be difficult to tell what’s legitimate. Look for personal finance advice on TikTok that’s simple and actionable, like budgeting or saving, and avoid creators whose promises seem too good to be true.

-

Social media can be a great source of advice on building a budget, paying down debt or learning how to invest. Just make sure to do your research, and don’t take all your information from one source.

Methodology

The study on savings accounts was conducted by YouGov Plc. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 3,581 adults. Fieldwork was undertaken between Feb. 20-23, 2024. The survey was carried out online and meets rigorous quality standards. It employed a non-probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results.

Bankrate commissioned YouGov Plc to conduct the survey on building wealth. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2,233 U.S. adults. Fieldwork was undertaken between Dec. 18-20, 2023. The survey was carried out online and meets rigorous quality standards. It employed a non-probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results.

Bankrate.com commissioned YouGov Plc to conduct the survey on personal finance outlooks. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2,391 U.S. adults. Fieldwork was undertaken on Nov. 13-15, 2023. The survey was carried out online and meets rigorous quality standards. It employed a non-probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results.

Read the full article here