Understanding the fundamentals of personal finance is pivotal for kids to successfully launch into the world of adulting. Money skills are necessary to navigate effectively through everything from life’s humdrum day-to-day tasks to its elaborate complexities.

Yet what surprises me is that most schools are still not required to teach financial literacy to students. Due to this knowledge gap, and the ever-increasing competitive nature of things, it’s more important than ever to teach our kids about personal finance before sending them off to college or out on their own.

My Experiences With Money Growing Up

When I was growing up, much of what I learned about money came from observing my parents. Most of the time, I heard them arguing about their differing opinions on spending and lamenting that we never seemed to have enough. They often complained about their inability to earn more due to not having graduated from traditional four-year colleges.

It was a bit depressing.

Fortunately, I didn’t let their struggles bring me down. Instead, knowing that I couldn’t rely on them financially once I reached adulthood motivated me to excel in school. I pushed myself to take on extra classes, allowing me to graduate six months early and gain a head start over my peers. With only myself to depend on, I became extra vigilant about how I managed my finances.

How Our Money Habits Influence Our Children

Since Sam and I are in a better position financially as parents ourselves now, we often wonder how differently our children will turn out when they embark into adulthood. Will providing them a comfortable life growing up make them soft as adults? One thing for sure is we don’t want our kids to grow up with an entitlement mentality.

We’re certainly motivated to teach them as much about financial literacy as possible due to our desire to educate people of all ages about money topics through Financial Samurai and our books. Leading by example is a great way for kids to observe and learn the benefits of building responsible money habits.

From budgeting and saving to investing and philanthropy, we as parents can showcase a huge spectrum of financial behaviors that can promote long-term financial well-being for our kids.

It is our responsibility to teach our children everything we know. Certainly don’t let all their education be left up to schools.

Personal Finance Fundamentals To Teach Your Kids

What are some of the most important basics of financial literacy that you should teach your kids? Here are eight important elements you can focus on and some easy ways to introduce each of them.

1. Explain purposes of money

Money makes the world go around, yet money doesn’t have any intrinsic value per se. It must be spent for its value to be unlocked. Therefore, it’s crucial to educate children about the purposes of money so they can grasp why parents work. Because if it were up to young children, they’d want to spend as much time with their parents as possible.

Kids typically first learn from watching us at grocery runs or running errands that money serves as a medium of exchange, enabling us to acquire goods and services. More importantly, money also represents value and can be used to achieve various financial goals, such as funding education, purchasing a home, and saving for retirement.

Some simple ways you can teach this concept include:

- Engage your kids in discussions about the role of money in your daily life.

- Explain how your job enables you to earn an income, how your earnings have changed over time as you gained more experience and expertise, and what you do with your paycheck each month.

- Provide examples of the types of bills you pay each month and their purposes.

- Share stories on some financial goals you’ve had, what you did to achieve them, and how long they took to complete.

- Introduce the concept of budgeting and demonstrate how money can be allocated for different purposes.

Help your children learn that money isn’t important only for short-term uses. While it is necessary to have sufficient cash flow to pay your monthly bills, money becomes more powerful and meaningful when it’s put toward larger, long-term goals.

Younger generations especially need our help with looking well beyond instant gratification, which is a big part of the FIRE movement.

2. Show importance of earning, saving and investing

At the heart of eradicating entitlement mentality is the need to work. By working, it instills in your children the importance of deserving only what they earn.

Teach your children the significance of paying themselves first. Additionally, instill in them the habit of treating all investments as expenses, embedding this mindset into their daily lives until it becomes second nature. By grasping the power of compounding at an early age, they can harness its exponential benefits in adulthood.

Parents can teach the importance of responsibly earning, saving and investing by:

- Involving children in household chores or tasks to earn an allowance, teaching the concept of earning money through work.

- Encouraging them to set savings goals and regularly deposit money into a piggy bank or savings account.

- Introducing the concept of investing by explaining what stocks, bonds, and mutual funds are. You can even show them your own portfolio.

- Helping guide their spending decisions by weighing the costs and benefits of purchases.

- Opening up a custodial Roth IRA when kids are able to work to give them ownership of their investments. Once children have ownership of their funds, watch how much more they care about their finances!

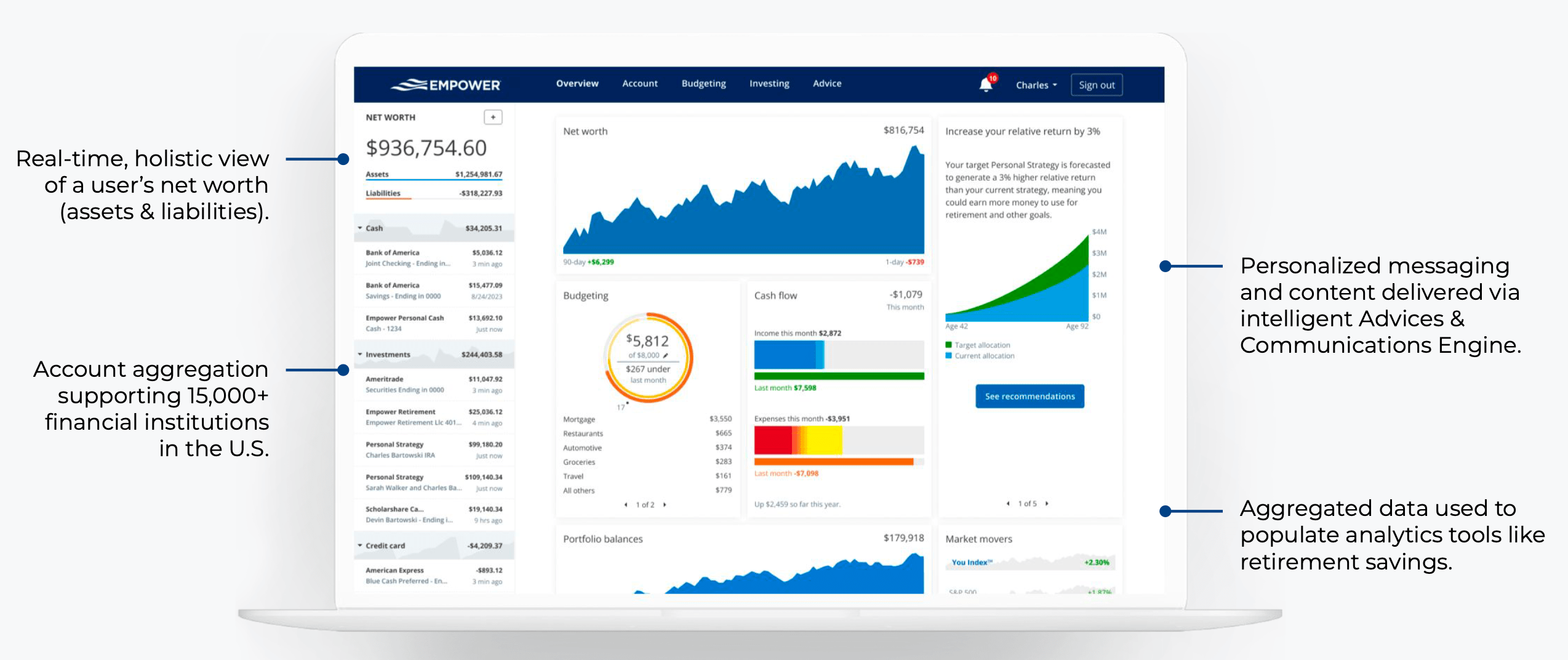

Below is a sample cash flow chart from Empower, my favorite free wealth management tool. We use Empower to illustrate to our seven-year-old son the importance of spending less than you earn, and the consequences if expenses exceed income. Utilizing charts is one of the most effective methods to teach children about personal finance.

3. Demonstrate banking basics – deposits, withdrawals, borrowing, and lending

Help your kids learn how how banks operate, the types of services they offer, and the importance of saving money for future needs or emergencies. Even though physical checks may be obsolete long before your child reaches adulthood (estimated to vanish by 2026 according to the Philadelphia Fed), teach them their function along with electronic payments.

Kids also need to understand how to make deposits, withdrawals, storing important things in safety deposit boxes, taking out loans, and the uses of debit and credit cards.

Here are some ways to introduce banking basics:

- Visit a bank to open a savings account in their name, exchange coins for crisp new bills, and see your safety deposit box.

- Show them what an ATM is and how to use one. Make a game out of counting how many you can find when running errands.

- Show them how to make mobile deposits on your phone.

- Set a goal to save for a new toy, book, outfit, pair of shoes, concert, etc. Help encourage and monitor their progress.

- Discussing the importance of emergency funds and saving for specific purposes, such as college or a vacation.

- Try the marshmallow test! Show them the rewards of patience – isn’t waiting a little bit worth it if you get to eat two marshmallows instead of just one?!

Even though we are moving toward a fully cashless society, I encourage you to use cash (either real or play money) when teaching your kids about money and banking. The tangible nature of cash is a much more powerful learning tool that the convenience of digital money can’t match.

Related reading: How To Start Investing In Stocks With Little Money

4. Explain the fundamentals of interest

Understanding the concept of earning interest on savings and investments is crucial for building wealth over time. Compounding interest allows money to grow exponentially, emphasizing the importance of starting to save and invest early. But not only that, it’s also crucial you teach your kids about how interest can become costly from a debt perspective.

You can teach these fundamentals in a variety of ways:

- Explain how interest works using real-life examples, such as a savings account or investment account.

- Illustrate the power of compounding by showing how small, regular contributions can grow significantly over time.

- Contrast that with the costs of borrowing money and taking on too much debt.

- Encourage your children to save a portion of any money received as gifts or allowances. Demonstrate how interest will increase their savings over time.

5. Teach your kids how to make wise spending choices

Learning to distinguish between needs and wants is essential for responsible spending. It’s also one of the more challenging concepts to teach young children.

How many times have you heard, “But, I neeeeed it!” However, it’s an important life skill to be able to differentiate between what’s truly essential and what’s desired. Let’s teach our kids how to stretch their dollars further by making them appreciate what they have. Growing wealth takes a lot of willpower.

Try out these exercises with your kids:

- Compare brand name items to generic ones at the store. Look at the similarities and differences in ingredients/materials, packaging, and price. Is the more expensive item really better?

- Involve your kids with grocery shopping and discuss the value of comparing prices and choosing cost-effective options.

- Encourage your children to create a budget and prioritize spending based on needs versus wants.

- Model frugal behavior by demonstrating the importance of delaying gratification and saving for future goals.

- Let them experience the consequences of their spending choices.

6. Explain the importance of earning money and diversifying income streams

Encourage your kids to explore the diverse array of income-generating opportunities available today. Beyond the conventional methods such as chores for an allowance, lemonade stands, or bake sales, there’s a plethora of alternatives.

These include selling unwanted items or consigning them, pursuing part-time or full-time jobs, engaging in gig work and side hustles, exploring entrepreneurial ventures, and investing. By familiarizing themselves with the various avenues for generating income, they get into a mindset of not relying on just their day job.

You can teach these personal finance concepts by:

- Offering your children a variety of age-appropriate opportunities to earn money.

- Encouraging part-time employment and internships during school breaks to teach the value of hard work and responsibility.

- Supporting entrepreneurial endeavors by helping children brainstorm business ideas, develop a business plan, and create a website.

- Opening an investment account for your child or practice making trades through an investment simulator.

7. Demonstrate the benefits of a strong work ethic

Instilling a strong work ethic in children is crucial for their future success. As parents, we aim to raise self-reliant children, and instilling these values early on is key. Grit and determination are lifelong skills empowering individuals to consistently strive for better results.

Parents can instill a strong work ethic by:

- Setting clear expectations for their children’s academic and extracurricular activities.

- Modeling hard work and dedication in their own careers and personal endeavors.

- Encouraging children to take on new challenges and persevere in the face of obstacles.

If you are a stay-at-home parent or a FIRE parent, all the more reason to do some work to demonstrate your own work ethic to your children. Even better if the work has a tangible final product to show your children.

One of the main reasons why we were so passionate about writing Buy This Not That, an instant WSJ bestseller, was because we wanted to demonstrate our academic work ethic. Once the book was finished two years later, our children could go to the bookstore and hold the final product in their hands. It is a wonderful book for teenagers to begin reading.

8. Help children become problem-solvers and critical thinkers

Our children will encounter countless challenges ahead. Instead of resigning in the face of adversity, we should encourage them to seek solutions. The better at problem solving our children become, the more adaptable and happier they’ll be.

At its core, Financial Samurai is a problem-solving website.

Hate your job, but can’t quit because you need the money? Negotiate a severance package.

Wondering how much to save in your 401k for retirement? Here’s my 401k savings guide by age.

Curious about how to responsibly spend money in retirement when economic conditions change? Study this dynamic safe withdrawal rate case study.

Here are some ways to foster problem-solving skills:

- Encourage your kids to think creatively and find solutions to everyday problems, e.g. how to share one awesome toy between siblings without fighting, how to get to school on time during a rainstorm, how to get a bully to stop bullying.

- Give them a list of brain teasers to help develop their critical thinking skills, e.g. What goes up and never comes down? Your age.

- Read about an entrepreneur who created something that interests them and talk about how they did it. For example, instead of just letting your kids play Pokemon, explain how Satoshi Tajiri created the Pokemon franchise and profited.

Incorporate Personal Finance Into Daily Conversations

We enjoy talking to our kids about money so they realize it isn’t endless. Every gift they receive just doesn’t come from nowhere. Instead, we explain to them that while they are in school learning, we spend time earning to pay for everything they have. Our goal is to ensure they don’t take the things they have for granted.

Having them pitch in with yard work, painting, and home repair has also been a fun and rewarding way for them to learn about property management. We also are having our son do chores to pitch in for our daughter’s hospital bill which resulted from him playing too rough with her one day. This not only reminds him to be more gentle with her, but it also teaches him the consequences of his actions.

Integrate personal finance topics into your daily conversations with your children. Over time, they’ll grasp concepts like opportunity cost and compound interest effortlessly. By the time they’re graduating high school, discussing potential stock investments will become as natural as walking.

Teaching your children about personal finance establishes a sturdy foundation for their future success. Their financial decisions will impact various aspects of their lives, from their living arrangements to their career paths and retirement strategies.

Remember, the Bank of Mom & Dad won’t be open forever. Ideally, we impart all our financial wisdom to our children before they embark on their own life journeys.

Reader Questions

Readers, were you taught personal finance basics when you were growing up? How did your parents influence your financial habits? For those parents out there, what money lessons are you teaching your kids? What do you wish you taught them sooner?

Financial Activity To Do With Your Children

One of our favorite activities with our son is exploring our Empower dashboard together, where we explain each component. He now has a fundamental understanding of net worth, which is assets minus liabilities. Consequently, he grasps that to accumulate more wealth, he must maximize assets and minimize liabilities.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter and to my posts via email here. Established in 2009, Financial Samurai is among the largest independently-owned personal finance websites today.

Read the full article here