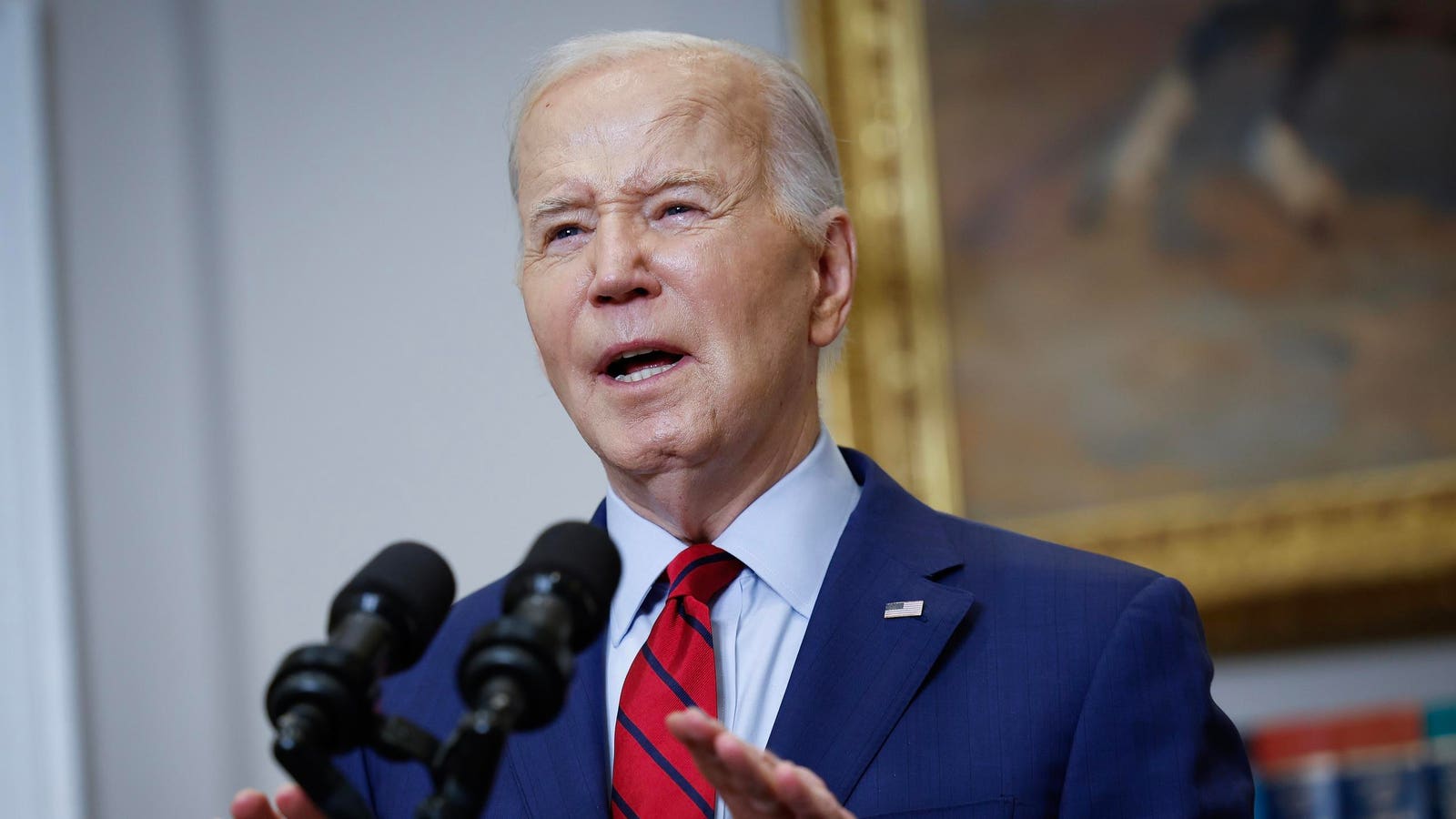

President Joe Biden announced a new batch of student loan forgiveness this week. With this latest round of debt relief, the administration has now approved upwards of $160 billion in loan forgiveness during the last three years, representing approximately 10% of all outstanding student debt.

Biden’s most recent group discharge approval is geared toward borrowers who attended schools accused of widespread misconduct. Providing debt relief for such borrowers has been a key component of the administration’s multi-pronged, piecemeal approach to implementing student loan forgiveness initiatives. Meanwhile, the Education Department is getting closer to launching a new mass student debt cancellation program.

“This is the latest – but not the last – step to hold bad actors accountable and get relief to folks who need it,” said Biden in a statement on X on Wednesday, indicating more loan forgiveness is in the works.

Biden’s Piecemeal Approach To Student Loan Forgiveness

In the wake of last summer’s Supreme Court decision striking down President Biden’s mass student loan forgiveness plan, the administration has utilized other tools to enact far-reaching relief. By updating, expanding, or relaxing regulations governing several existing loan forgiveness programs using executive authority, the Education Department has managed to cancel student loan debt for at least 4.6 million borrowers. This includes:

- Close to $50 billion in loan forgiveness through the IDR Account Adjustment, an initiative designed to address longstanding problems with income-driven repayment plans. Nearly a million borrowers have already benefited, and more borrower should qualify in the coming months as the Education Department completes implementation.

- Over $60 billion in loan forgiveness for close to 900,000 nonprofit and government works through fixes and improvements to the Public Service Loan Forgiveness program. This represents a 100-fold increase in PSLF approvals since 2020.

- Nearly $5 billion in debt relief through an “early” student loan forgiveness feature of Biden’s new SAVE plan, an income-driven option that results in lower payments and faster debt relief for many borrowers.

- More than $14 billion in discharges for borrowers with a disability, following regulatory changes that removed bureaucratic barriers and streamlined relief for many people struggling with disabling health conditions.

$28 Billion In Student Loan Forgiveness For Borrowers Harmed By School Misconduct

In addition, the Biden administration has approved more than $28 billion in student loan forgiveness for 1.6 million borrowers who were harmed by their schools, such as through misrepresentations or by closure. The Education Department has approved this relief under several existing programs such as Borrower Defense to Repayment and the Closed School Discharge initiative, as well as court settlements.

The latest round of debt cancellation announced this week centers on the Art Institutes, which the department found has engaged in a pattern of misleading prospective students about career prospects, earnings, and job placement services. More than 300,000 former Art Institute students will receive automatic group discharges in this latest batch of relief. This is similar to group discharges approved for former students of Corinthian Colleges and ITT Technical Institutes, two other national for-profit college chains that closed.

“My Administration is cancelling $6.1 billion in debt for 317,000 borrowers who attended the Art Institutes, an institution that falsified data and cheated borrowers,” said President Biden in his statement on Wednesday.

Biden’s New Student Loan Forgiveness Plan Could Debut This Fall

Meanwhile, the Biden administration is finalizing plans to establish a new student loan forgiveness plan, intended as a so-called “Plan B” to the program that the Supreme Court blocked last year.

This new plan will target relief toward specific groups. This includes those who have experienced significant interest accrual and capitalization; those who entered repayment more than 20 or 25 years ago; people who qualify for existing student loan forgiveness plans but haven’t applied or enrolled; and former students who attended institutions that lost access to federal financial aid programs due to poor outcomes or were otherwise deemed to be “low-value” schools.

Last month, the Education Department released formal regulations governing the program after a lengthy rulemaking process. The regulations are now open to public comment until May 17th. After that, the department will release a final version of the regulations. The plan is not set to launch until sometime this fall, and is likely to face legal challenges.

Another Student Loan Forgiveness Option Based On Hardship

As part of Biden’s new broad-based loan forgiveness plan, the administration is also proposing a fifth pathway to relief based on hardship. The Education Department has not yet released proposed regulations governing this option. But based on a prior public rulemaking hearing, the department will likely consider multiple factors in evaluating a borrower’s eligibility for hardship-based loan forgiveness. These include age, disability, income, expenses, other debts, and prior approval for other public means-tested benefits.

Critics of President Biden’s piecemeal approach to student loan forgiveness have urged the administration to go as far as possible with this upcoming hardship-based debt relief initiative. Some advocates have called on Biden to classify student loan debt a hardship in and of itself, thereby wiping out most existing student loans.

However, the Education Department seems unlikely to do this. Officials believe that a targeted approach to debt relief is more likely to withstand legal challenges. But with a Supreme Court that seems hostile to any loan forgiveness initiative, it is unclear whether any broad-based debt cancellation plan would ultimately be upheld.

Read the full article here