For over a decade, I’ve been witnessing a phenomenon that has left me scratching my head. A commenter will say how the economy is suffering and people are experiencing financial hardship. Then, when I ask them about their personal hardships, they say they’re doing great.

This disconnect has been repeated over and over until I realized that the gloom some people feel or claim to notice is simply not real. Yes, of course some people are experiencing economic hardship. I don’t want to minimize their difficulties. I’m just not sure it’s as prevalent as people say or think it is.

The very people who say others are suffering but are doing great themselves are the other people! Given that most of the people who comment negatively are actually doing great, it stands to reason that most people are doing great.

I haven’t been able to back up this observation with data until now.

The Financial Doom And Gloom You See Is Probably Not Real

The 2024 Federal Reserve Survey of Household Economics and Decisionmaking came out with fascinating data that sheds light on how American households are doing.

Near the end of 2023, 72 percent of adults reported being at least okay financially, meaning they reported either “doing okay” financially (39 percent) or “living comfortably” (33 percent). The rest reported either “just getting by” (19 percent) or “finding it difficult to get by” (9 percent).

To no surprise, inflation was the most common challenge, with more than one-third of respondents identifying it as such, followed by basic living expenses and housing. Meanwhile, thirty-one percent said they did not have any financial challenges or concerns.

Here’s the survey result asking how American households were doing, broken down by education level. Among respondents with a Bachelor’s degree or higher—which includes most readers of Financial Samurai—87% reported being “okay financially” or “living comfortably.” These were the top two choices in the survey.

If the survey broke down the responses by homeowner and renter, we’d likely see more optimism from homeowners given the rise in home prices.

Inconsistency Of Financial Reality And Thought

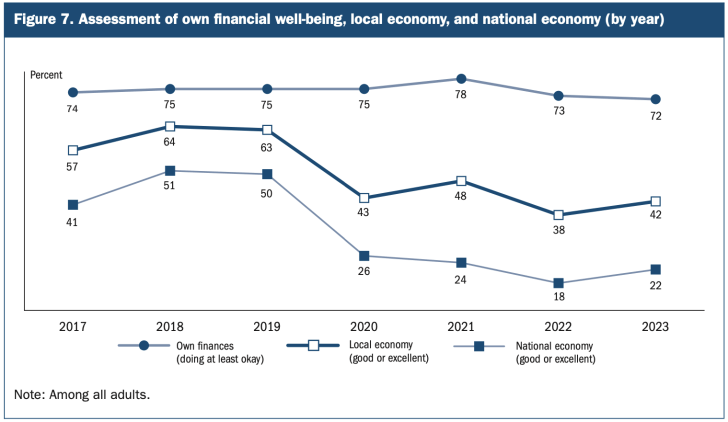

Now, here’s the real gem I’ve been waiting over a decade for. This chart highlights the assessment of one’s own financial well-being versus their assessment of the local and national economy. Notice the massive 50% gap (72% and 22%) between one’s own financial well-being and one’s view of the national economy!

For some reason, despite most people doing okay themselves, the majority also believe the local and national economy are struggling. It’s these well-off individuals who I think are the most unhappy because their thoughts are inconsistent with reality.

Incongruence Makes People Unhappy

One of the most important concepts on Financial Samurai is the importance of congruence. If your thoughts and actions align, you’ll build more wealth and live a more purposeful and happier life. Here are some examples:

Instead of complaining at the water cooler about your micromanaging boss, you transfer departments or find a new job. If you’re wise, you’ll negotiate a severance package, alleviating the immediate pressure to jump back into a similar situation.

Instead of criticizing the writing on a free personal finance site, you start your own personal finance blog and write what you want to read. Only then will you appreciate how challenging it is to produce useful or entertaining content regularly. Your complaints will diminish as you gain appreciation.

Instead of envying those in better shape, you cut sugar from your diet and walk 15,000+ steps a day for a year. If you maintain this habit, you might wonder how you ever lived differently.

You get the idea. With congruence, you’re no longer a passive audience member throwing peanuts at a suboptimal performance. Instead, you take action to improve your life.

If you find yourself debasing the national economy but are doing well yourself, cut it out if you want to feel better.

We Trick Our Minds To Make Ourselves Feel Better (Or Worse)

My theory about the large disconnect in the Federal Reserve survey results is that it stems from the mind games we play on ourselves.

Would you rather earn $100,000 a year while others make $200,000, or $200,000 a year while others make $300,000?

Behavioral economics studies show most people choose the first option, preferring to make relatively more than others even if it means earning less overall. It sounds irrational, but it’s entirely rational.

When it comes to money, everything is relative. If everyone makes $1 million a year, earning $1 million isn’t considered rich but middle class. To get ahead, we feel we must make more than our peers. Not only must we make more, we must have more and do more!

People feel better about their own finances when they believe the economy or others’ finances are worse. Simultaneously, it makes us feel better about ourselves when we portray our finances as better than they are.

Of course, the $500 dinner was amazing! Even if it lasted two hours too long and you’re still hungry afterward, you need to signal to the world that it was fantastic, complete with Instagram pictures of every dish. Otherwise, you might feel foolish for spending so much.

For a carnivore, can anything really beat the value of a $3.95 In-N-Out Double-Double cheeseburger? Probably not.

Be Careful Being Too Optimistic in Public

We’ve learned that believing everyone else is doing worse than us may be a coping mechanism for our own financial insecurities. We’ve also learned that being congruent with our thoughts and actions is essential for living happier lives.

The final lesson is to be cautious about being overly positive when talking to friends or acquaintances. As the saying goes, “misery loves company.” To be better liked, it’s smarter to share your struggles rather than your wins, a Stealth Wealth strategy. The more struggles you share, the better others will feel.

“Hey! Maybe my thoughtless husband who never cleans the kitchen and goes golfing every weekend isn’t so bad!” After you hear your friend complain about how her husband goes on “business trips” to New York City every month for a week. When in reality, he’s just trying to get away from the kids and hang out with his buddies.

“I guess living in our paid-off 1,200-square-foot, two-bedroom home is pretty good! Jim told me he’s stressed because his wife wants to go on an expensive family vacation with a couple of other families, but he’s struggling to pay the $15,000 a month mortgage on his 3,800-square-foot home.“

The last thing someone wants to hear is how awesome someone else’s life is. If you must shout from the rooftops about your fabulous life, balance it out with some negatives. You might even do some faux virtue signaling by leaving a comment about how others are suffering while you’re doing great.

If you do, just be aware of it. Because if you unknowingly practice incongruency, you might be masking deeper financial problems.

Related post: How To Convince Others You’re Middle Class When You’re Actually Rich

Reader Questions

Have you noticed people saying how bad the economy is, yet claiming they are doing great themselves? Why do you think there’s such a big disconnect? Do you think most of us who have this disconnect are aware of it?

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter or get my posts in your inbox by signing up here. Financial Samurai as established in 2009 and everything is written based off firsthand experience.

Read the full article here