The opportunities for financial advisor education have improved so dramatically in the past 25 years. When I graduated from college with a generic business and finance degree, only a couple of mainstream colleges were known for doing anything with financial planning and virtually no degree programs were available. Now, more than 200 degree programs are available at the bachelor’s, master’s, and even doctoral levels.

The CERTIFIED FINANCIAL PLANNER™ designation was a thing back then, but today, there are many more (and better) paths to satisfy the education requirement, and the number of CFP® practitioners has almost tripled. While the vast majority of my training to be a financial advisor came on the job and through self-study, today the opportunities for building that base level of education in the practice are plentiful.

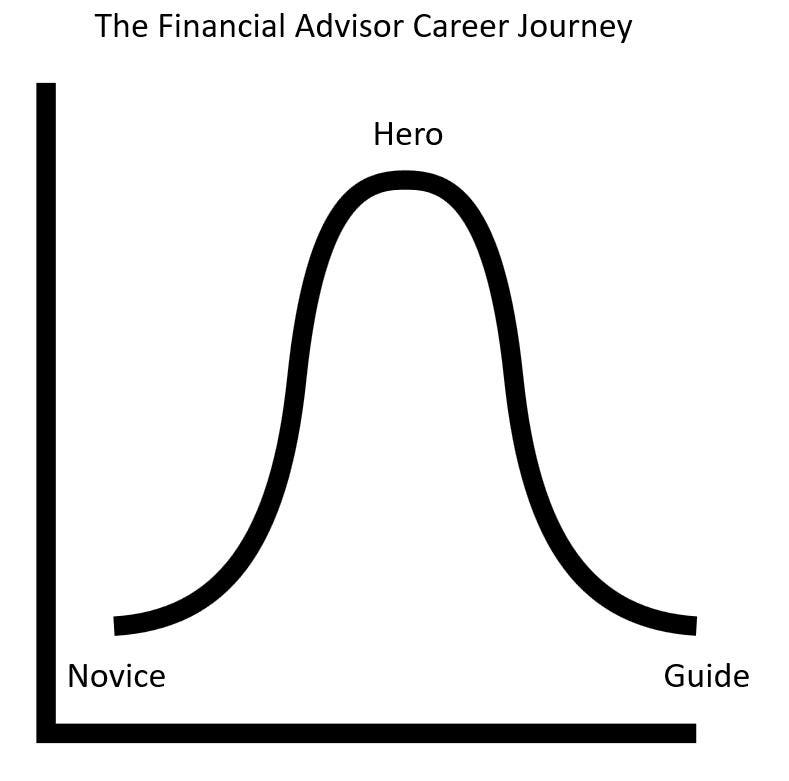

Yes, times have changed, but one thing remains the same: Many, if not most, of us financial advisors follow a similar arc in our careers that has far less to do with education and far more to do with disposition—from humble novice to knowledge-wielding superhero to wiser guide. By taking a quick glance, clients can identify where their advisor sits on this unfortunate bell curve, while advisors earlier in the arc can hopefully avoid the bubble in the middle.

Novice

As brand-new advisors, humility comes easier, partly because the gaps in knowledge are so glaring. This is because financial planning isn’t a single subject you can study, but a multi-disciplinary practice that is simultaneously deep and wide.

It’s wide because it at least spans from investment to insurance to retirement to tax to estate planning, subjects that, while inextricably intertwined, are distinct enough that they require a great deal of individual dedication. And it’s deep not only because each educational pillar is complicated, but because the true subject—humankind—is complex.

- For more on the difference between complicated and complex, you can read more HERE.

Hero

The steep learning curve in financial planning creates a certain slingshot effect for many of us. In the early years, we wanted so badly to be seen as knowledgeable and trustworthy, but we have to warehouse this desire until we a) actually know stuff and b) get a chance to show it. The intersection of those two points leads to the most challenging place in an advisor’s career—the Hero phase.

Once an advisor gets some knowledge and is released into the wild of prospect and client-facing interaction, the opportunity to prove ourselves worthy of the advisor title often proves too enticing a temptation not to “spill all our candy in the lobby.” I remember thinking that my job was to answer all the unasked questions in the room and thinking the success of a meeting was gauged by how much information was transacted. Unfortunately, this made the meeting more about me, my firm, and our processes and procedures—and less about the client. It was all about our features instead of the client’s benefits.

This syndrome isn’t just about vanity, though. At its best, ours is a helping profession, and many of us early in our careers just want to help, unknowledgeable of the fact that it is not knowledge but understanding that is the goal of client interaction. Indeed, however well-intentioned, if we, as advisors, are consuming most of the space in the room, we’re missing out on an opportunity to position the client as they—you—should be, at the center of the discussion and discernment process.

Sadly, some advisors never grow out of this phase, only growing hardened in what almost becomes a gamification of client interaction—seeking to arrive ever quicker at a revelatory recommendation, often prematurely, a demonstration less of wisdom than pride.

Guide

And have no doubt: Wisdom is the ultimate goal. In any pursuit, we move from raw knowledge to understanding through practice, and then, hopefully, to wisdom. True wisdom is quieter, modest, patient, reflective, empathetic, curious, flexible, practical, and yes, exceedingly, if not increasingly, rare.

In this age when the knowledge at our disposal is reaching hyperbolic proportions, the challenge is so much less about knowing what to do and even how to do it, but better understanding why. The goal isn’t just wealth accumulation and distribution, but wealth with purpose.

Donald Miller highlighted for us in his book, Building A Storybrand, the arc of nearly every story, from the best commercials to movies and books, and the inherent imperative for us, as advisors, is to be reminded (daily, if need be) where we—and our clients—are positioned on this arc:

True wisdom knows who the hero of every advisor-client relationship really is—the client. It is the client’s motivation, insight, and self-knowledge that the guide hopes to reveal and the client’s successful outcome that is to be pursued.

The great news is that when we realize this as advisors, we are free to be even more effective in our less visible role. We are free to take off the hero cape and step into the vital role of guide in the client’s story.

Read the full article here